WPP – friendless & unloved – perfect!

Not all marketing investment seems wasted. After P&G’s earlier withering criticism of its digital marketing ROI, Diageo’s Q2 report yesterday, delivering a combination of rising A&P investment, organic sales growth and underlying operating margins, suggests a more nuanced approach may be needed by investors to the industry’s current problems.

Faced with an unsolicited approach from Kraft Heinz, much has been made of Unilever’s adoption of ‘Zero-based-budgeting’ and squeeze on agency fees, but this hasn’t stopped them from increasing marketing investment. This theme was also repeated by Colgate;

“Advertising investment increased both absolutely and as a percent to sales versus year ago across every operating division in the fourth quarter and for the year. We intend to increase our advertising investment in 2018 and to maintain the continuity of that investment throughout the year in support of new products, our base businesses and longer-term consumption-building activities.”

Marketing investment can work and more can work better, when there is enough growth in consumption to address. Conflate clicks with conversion however, and throw too much money into marketing budgets because cheap money has increased the expected marginal return and you’re heading for a fall, particularly once rates rise and marketers start questioning the effectiveness while also worrying about future growth in demand. This was pretty much where we were at the end of 2017 and where investors are beginning to catch-up with now into the start of 2018. As usual with the marketing services agencies, investors having been slow to accept the swing in what is still a cycle and are again discounting the tangent growth rate from the last data point on the chart.

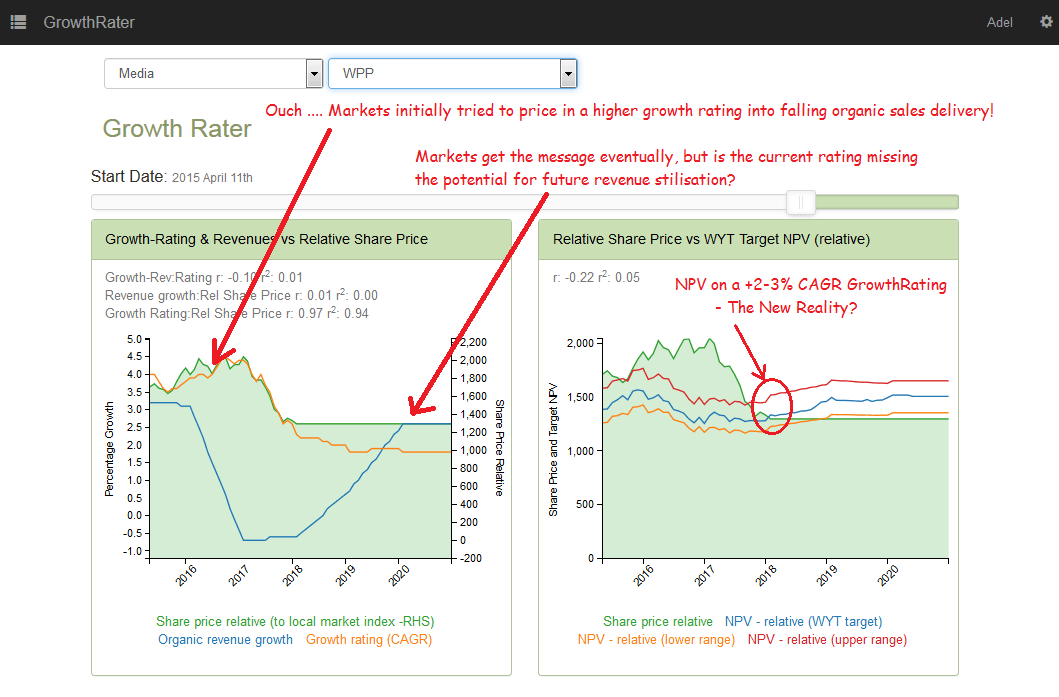

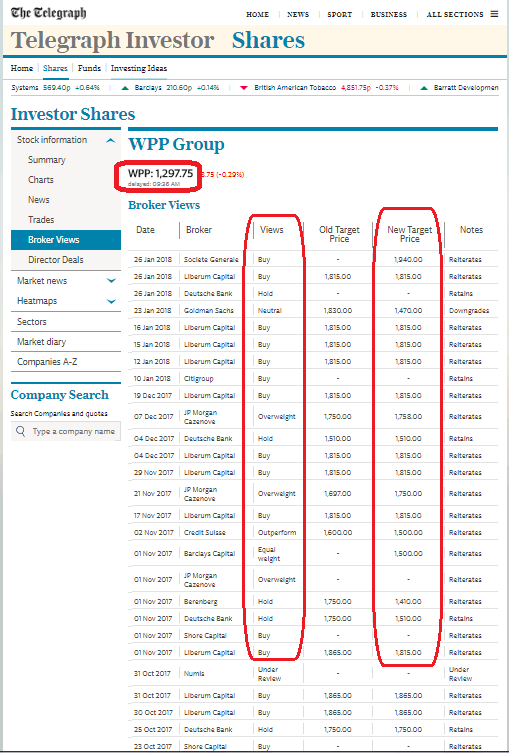

For WPP, that meant a consensus that was happy to chase the stock with valuations that were implying increasingly unrealistic implied growth assumptions, despite the clear indigestion their clients were feeling towards their marketing budgets. Review the valuation from the perspective of the relative growth of organic revenues delivered versus the implied growth being discounted from the OpFCF yield (below) and the relationship becomes fairly self-evident, albeit the reactive rating argues against the markets predictive powers. Those brokers (see list at bottom) pushing the shares last year from an already elevated GrowthRating of over +4% CAGR while the organic sales trajectory was crashing below +3% were clearly not pursuing an investor friendly proposition, even without the benefit of hindsight.

All this however is now history. At issue is whether the markets have again over-reacted by pricing in a growth discount of only +2% CAGR. While the Diageo experience, Colgate projected marketing growth and improving global GDP expectations might suggest the stock is over-sold, it’s not going to answer the short-term question of whether Q1 organic sales will be +2% or -2%; which unfortunately is the key data point to determine if its safe to catch this one here for day traders. As I run on a 3-6 month investment horizon however, a sub £13 stock price provides enough of a prospective return to support the risk which is why I’ve just added it to the GrowthRater portfolio.

While I might hesitate to endorse Publicis’s ever-ebullient Maurice Levy’s prediction that “2018 will be a great year for the Ad industry“, one merely has to avoid the recession currently discounted in many agency valuations to establish an attractive entry point for investment. More on this can be found at

https://app.growthrater.com

The herd

Shoaling might seem a good defence to a fish, although anyone whose seen what happens to a bait-ball of sardines may need to revise that opinion; something many investment banks may now also be considering in the brave new world of post MIFID2 research!