Bonds

Bonds - the great normalisation

Like every ponzi scheme, there comes a point at which the weight of previous liabilities fall due and to mangle Warren Buffet's analogy "Only when the tide goes out do you discover who's been swimming naked". For governments who thought that endless debt monetisation camouflaged with QE interest rate suppression was a clever way of paying the bills are now discovering the deferred reckoning in the form of inflation. 'Modern Money Theory' (MMT) was in fact no more than a delusional 'Magic Money Tree' where future consumption would have to be sacrificed for those previous deficit spending sprees.

This has now taken us to an interesting fork in the road for the US Federal Reserve. Does it risk a currency collapse by continuing to monetise the governments continued deficit spending, or adhere to its planned monetary tightening, including its $95bn per month unwind of its own bloated balance sheet? As if to spice up this pot, we have China and Russia coordinating a currency trading block aimed at challenging the US dollar's reserve currency status, while on the other hand we already have a number of bank failures, including an increasing tail risk from long dated bond losses.

My own view on this is that the US dollar and its reserve status remains its single most important policy position and which is pivotal to its overall foreign policy. This would seem to be confirmed by the continued resolve of the US Fed on its monetary tightening, including the further +25bps rate hike even following the collapse of SVB and Signature Bank. Self interest by the US Fed meanwhile also ought not be under-estimated, with CitiBank and JPMorgan Chase being the two largest shareholders of the NY Federal Reserve Bank (at approx 42.8% and 29.5% respectively). Some may have read reports of some rather large short positions on gold derivatives and in particular at JPMorgan Chase. Should the US Fed embark on a monetary lossening and risk an inflationary spiral and currency devaluation, exactly what would one imagine would happen the the gold price then? Not exactly something one would want to see if nursing a very large short position, particularly if representing a systematic risk on a 'too big to fail' partial owner of the NY Fed!

If the US Fed has stopped monetising debt and indeed is reversing past QE by approx $1.1tn pa ($95bn pm) and a Republican Congress blocks further tax increases, then the US Treasury will either have to reverse its planned fiscal expansion or borrow a lot more. As its current deficit is already running at over $1tn pa, this, added to the existing US Fed balance sheet tightening, will mean buyers of at least $2tn pa of new US government debt will need to be found. This at a time when the ECB, BoE and BoJ are all doing the same. By forcing central banks to tighten monetary policy, rising US inflation and deficits are restoring the market pricing of capital and in this circumstance, this competition for funds will continue to drive up yields. For those already squealing when 10 year Treasury Yields hit 4% ought to remember the pre-2008 normalised rates were nearer 4.6% and that was on a lower average prospective inflation number. Today, with inflation at approx +6% YoY, even assuming this drops by -100bps pa before settling at 2%, this would suggest an average inflation rate over the course of a 10 year Treasury of approx 3.7% pa. Add in a normalised real yield returning to 1-2pts and the fixed 10 year Treasury yield ought to be nearer 4.7-5.7%, rather than the current sub 4%.

10 year comparative yields

The Euro area is a fiscal basket case that lacks a guaranteed tax base for its fiat currency, yet was briefly able to manipulate down its average 10 year Govt bonds yield to -200bps discount against comparable US Treasuries.

Alas, no more as rising US rates and monetary tightening forces a comparable response from all other central banks. Roll-in the ECB's more stretched balance sheet position and the increased push for political union (to secure the 'transfer union') becomes more understandable.

Inflation expectations

QT replaces QE and its everyone for themselves as central banks compete for investor capital. Yields are both rising, but interestingly with thise of US and EU once again converging.

Yield curve

The flattening of the yield curve is often cited as the prelude to recession, albeit this can sometimes persist for years without such an event. More relevant is when the short-end of the curve breaks lower following such a period as this is often an indication of central bank panic liquidity injections as it sees evidence of said recession.

The Fed flip-flop from November 2018 and the recommencing of its 'non-QE QE' from Q3 2019 provides a somewhat worrying case of 'deja-vu' on this subject! Fortunately, Jerome Powell has for now stuck to his QT plans

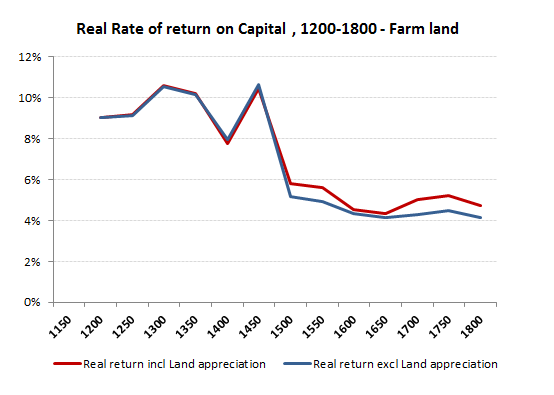

European land rents real ROIC 1200-1800

Land rents

A 4-5% pa real ROIC on Land from 1500-1800, yet we are supposed to believe a sub 1% real Treasury bond yield is the new normal after just a few years of massive central bank manipulation.

While evidence of interest rates on loans extends back to the usurious Mesopotamians at 20% pa, most rate in antiquity seem to have ranged from the Greeks 10% (dekate), the Romans 8 1/3rd (ubcia) and down to Justinian’s 5%, so perhaps not so alien to the more recent experiences, pre QE that is!

Better records since the Middle Ages on both Land returns and rents, together with inflation and land values however, provide a more reliable metric for returns, both absolute and real. Using research from Gregory Clark (UC-Davis), one can see a relatively high gross yield was available on property in the middle Ages of around 10% pa actual and between 8-10% real, but the dropping to a relatively stable 5% pa from 1500’s to the 19th century, with real yields of just over 4% pa.

Source: The Interest Rate in the Very Long Run: Institutions, Preferences and Modern Growth Gregory Clark (UC-Davis) April 2005 gclark@ucdavis.edu