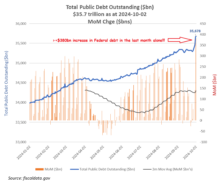

So much for fiscal probity!

For currency markets and bond vigilantes, Trump is proving to be a great disappointment, particularly against the initial high hopes of a return to honest financing following the election rhetoric and the early progress on DOGE by Elon Musk. The initial rally in the USD has now reversed as Trump’s bloated “One Big Beautiful Bill […]

Continue reading