- Home /

- Jerome Powell

The mighty US dollar – ruling over the ashes

At times like this it is difficult to comprehend whether there are any adults left at the helm in the US. Jerome Powell’s attempts to ape his failed predecessor, Arthur Burns, is unraveling as fast as gold prices and bond yields are rising in the face of a so-called Republican Congress seemingly incapable of reining […]

Continue readingDeja Vu – but have the lessons been learned?

“Follow the Fed” has been a winning investment strategy, but that ought to be confined to what the central bank is actually doing rather than the narrative that it is trying to communicate. Since early December, that narrative has been plainly on offer, with Fed Chair Jerome Powell signalling a series of interest rate reductions […]

Continue readingThe power of one – WWG1WGA

No, I’m not referring to Qanon, but to the US Federal Reserve. Those central banks out there who thought they could get a free ride behind the Fed’s excessive monetary easing for a decade and a half, are now discovering that it came with a price, when the Fed started to pull back some of […]

Continue readingMarkets try to second guess the Fed, but perhaps all now irrelevant

That favourite pastime for markets has been to try and anticipate the Fed’s next move, which to be fair, has been the defining equity investment strategy for over a decade and a half. That however, presupposes that it remains in charge of events rather than now increasingly being at the mercy of them. So while […]

Continue readingUS Federal Reserve – all gong no dinner!

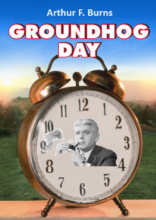

Having flunked the very first month of its balance sheet unwind that was articulated in its 04 May ‘cunning plan’, the US Federal Reserve will find that the alternatives will prove no more palatable than those following the inept tenure of that chair up to 1978, Arthur Burns. Sure, the immediate response to Jerome Powell […]

Continue readingIs the US Fed bottling out already?

Jerome Powell seems eager to talk the talk on tackling inflation, but has yet to walk the walk. According to his 4 May published plan, the initial reduction in the Fed’s balance sheet should have kicked off at approx $47.5bn per month from 1 June, rising to $95bn per month by September. However, in the […]

Continue readingGoldilocks, or just cognitive dissonance?

So 9 years after Mario Draghi salvaged markets with his infamous “Whatever it takes” promise by the ECB, his current counterpart at the US Federal Reserve, Jerome Powell is attempting to repeat the trick, with his testimony to US House of Representative this Monday (21st June) where he promised “We at the Fed will do […]

Continue reading