- Home /

- GrowthRating

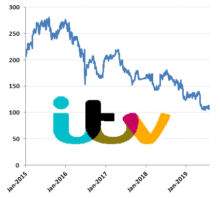

ITV – a mean reversion

When in doubt, it seems we all try and cling on to our normalcy bias. While ITV (itv_l) might seem an odd example of markets use of a ‘mean reversion’ to provide a valuation anchor point, this very much depends on the metric used and the perspective sought. Use a fixed metric such as a […]

Continue readingPearson – resorting to one-off non-cash tax items to try and spice up a tired recovery story

Pearson was for a while the darling of the sector, with a recovering top line supported by substantial cost reductions and an fx tailwind from the appreciation in its principal trading currency, the US dollar. Beyond this however, there was only limited evidence that the ship is being turned about, in terms of what really […]

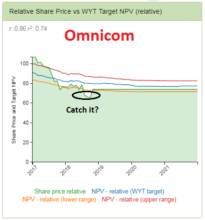

Continue readingOmnicom – yes it was oversold after Q2!

After seeing its shares tumble 10% immediately following its Q2 results, I added a position in Omnicom across a couple of portfolios I manage. It wasn’t that I was won over to the structural growth story for these marketing services agencies, but more a function of two things. Firstly, there is a price for everything […]

Continue readingWazzup – 23rd May 2017

Chemicals day at Wazzup. – Yesterday’s $14bn merger announcement between Huntsman and Clariant show that it can be done, notwithstanding Akzo Nobel still playing ‘hard to get’ in face of PPG’s multiple advances. With the sector also at the cusp of pushing through price rises to recoup earlier increases in raw material and […]

Continue readingEastman Chemical – when a picture is worth a thousand words

What is an equity, if not a participation in a cash flow stream where the yield can be determined by the prospective growth? With the correct methodology and cleaned up data, the GrowthRater does the heavy lifting for you to provide you with that perspective. The message is simple – BUY growth when it […]

Continue readingeBay added to the GrowthRater model portfolio (close price $24.49)

It is comforting to see the group firm up the lower end of its constant fx revenue growth range for both Q2 and the FY16 after a better than expect outrun for Q1. The group however is not out of the woods just yet as the platform rejuvenation still needs to be completed and the […]

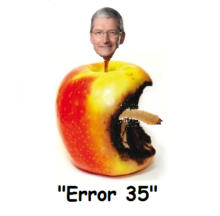

Continue readingApple – when a picture is worth a thousand words!

Okay, so we’ve got Apple’s Q2 results out tomorrow and expectations aren’t very ambitious (see Outlook in below Investment Summary). It’s the big issue that is going to get the share price right however, and by this, whether we are looking at a re-run of Sony over two decades ago after Akio Morita stepped down. […]

Continue reading