- Home /

- Uncategorized

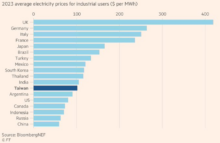

Hidden taxes to fund the parasitic state

If you want to understand why the UK and Europe are in industrial decline there is no better chart than looking at the comparison of electricity prices by country. Is it any wonder the UK will soon no longer have a steel industry and Germany’s de-industrialisation is not far behind? Of course this competitive disadvantage […]

Continue readingJapanese MMT – the last domino to fall

Rising wage settlements and the falling Yen may have finally forced the Bank of Japan to reverse its negative interest rate policy, if recent media leaks ahead of its March meeting are to be believed. Behind this however, is the inexorable pressure to fund structural deficit spending when previous debt monetisations are cascading through into […]

Continue readingGreed fed by fear and the Fed

It’s been a pretty good ‘pandemic’ for markets, although one doesn’t have to look too far to see what’s been feeding it. What next, the Fed variant?

Continue readingWhen governments panic

The -713k contraction in US private sector employment in March was as dire as expected, but after the approx +6.4m increase in initial unemployment claims already reported in the two weeks up to the 28th March, this represents merely an hors d’oeuvre to what is coming down the pipe, With only limited effective testing (including […]

Continue readingQ1 GDP – too good?

Better than expected Q1 GDP growth in both China and the US, may not be as positive for asset prices as the initial market reaction might suggest. Not only does it dispel some of the more ambitious hopes for additional fiscal and monetary stimulus, but it also serves to encourage each side to dig in […]

Continue readingCurrency tail wagging investment dogs

A safe play would seem to be to bet on UK Sterling weakening further. What matters is not that a ‘Hard Brexit’ might turn out a lot better for the economy than portrayed by ‘Project Fear’, or that Theresa May could still manage to secure Brino, but that evidence of the former would be beyond […]

Continue reading“Normal profits are becoming normal for airlines” – be afraid!

Recency bias is alive and well. “At long last, normal profits are becoming normal for airlines”, so says the IATA in its June 2018 industry update titled “Solid Profits Despite Rising Costs”. After a couple of years of improving margins and ROIC, is this a paradigm shift for investors to jump aboard? Unfortunately, it feels […]

Continue readingM&S – for once without the flannel

Being long into the M&S results, I was understandably happy to root for the old girl as she struggles to re-invent herself for the modern world. The numbers themselves were broadly as expected and while it was comforting to have the dividend not only held, but forecast to remain that way, I was never in […]

Continue reading