Japanese MMT – the last domino to fall

Rising wage settlements and the falling Yen may have finally forced the Bank of Japan to reverse its negative interest rate policy, if recent media leaks ahead of its March meeting are to be believed. Behind this however, is the inexorable pressure to fund structural deficit spending when previous debt monetisations are cascading through into rising inflation and falling demand thereby forcing governments to borrow, rather than print. This however, is a global phenomena; it was just that Japan had been a holdout to this process of interest rate normalisations. In case we needed reminding, what this again shows is that if the US financial tail wags, inevitably so do the global dogs. As much as this pivot on monetary policy in Japan might be ascribed to domestic factors, the timing has more to do with the growing realisation of the persistent strength in US core inflation and therefore interest rates in the face of a tsunami of US treasury bond issuance this year. And as with any commodity, more competition for money when supply is restricted forces up the price, which of course is represented by the yield, or interest rate.

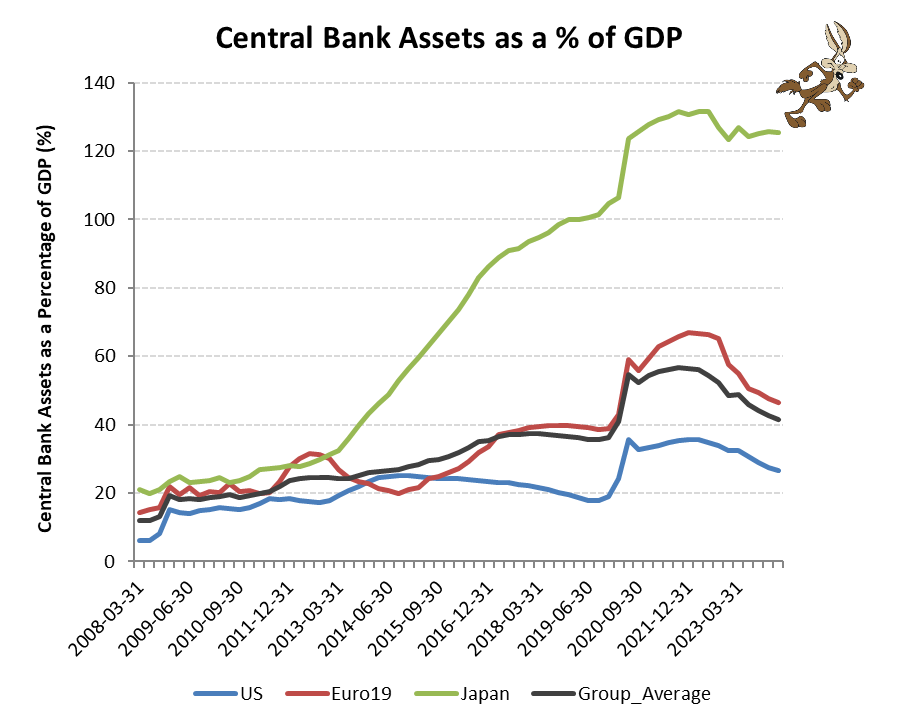

When the US Federal Reserve commenced its experiment with MMT in 2009, it encouraged other governments to follow suit in what became a coordinated manipulation of interest rates and debt monetisation under the pretense that the debt bought back to sit within central bank balance sheets would ever get sold back into the real market. Fickle politicians were obviously encouraged to avoid tackling their structural deficits and just keep spending and printing under the cover of the US Fed and the artificially lower interest rates and camouflaged inflationary pressures. By tightening its monetary policy and reducing its asset holdings, the US| Fed however, has effectively pulled the rug on not just the MMT policy, but on a number of other central banks/governments who recklessly expanded assuming negative real rates was the new normal. Remove the Fed though and as we are seeing, all the dominoes start to fall!

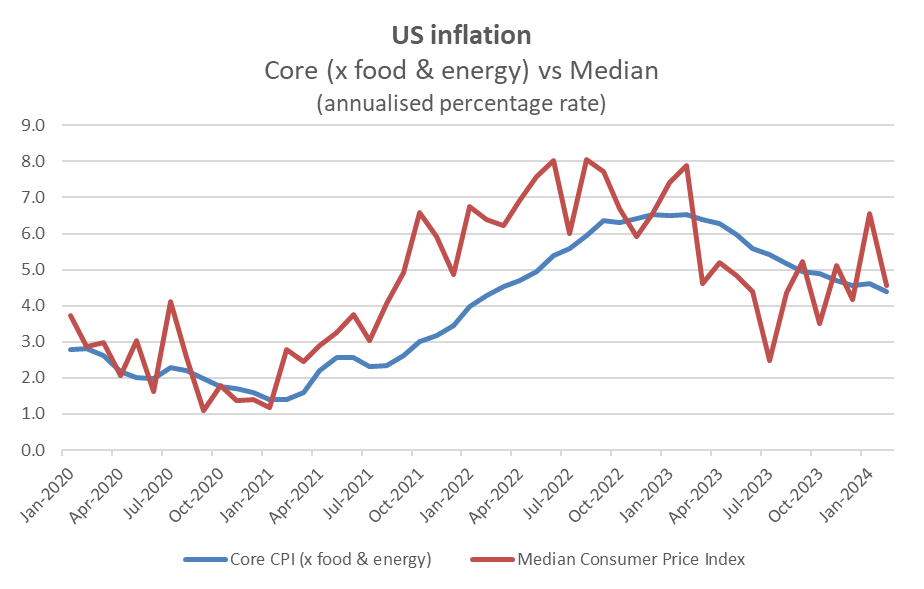

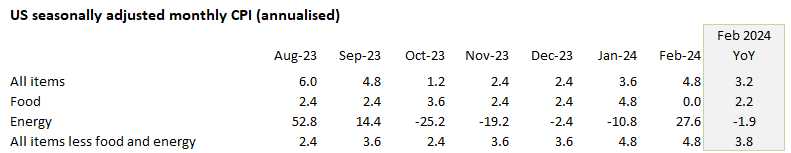

Meanwhile back in US land, the fiscal problems remain unresolved, while persistently high core inflation is pushing back the early monetary easing narrative that markets have been avidly pursuing since Jerome Powell initiated the ‘pivot’ narrative at the end of 2023.

US Core inflation remains a threat

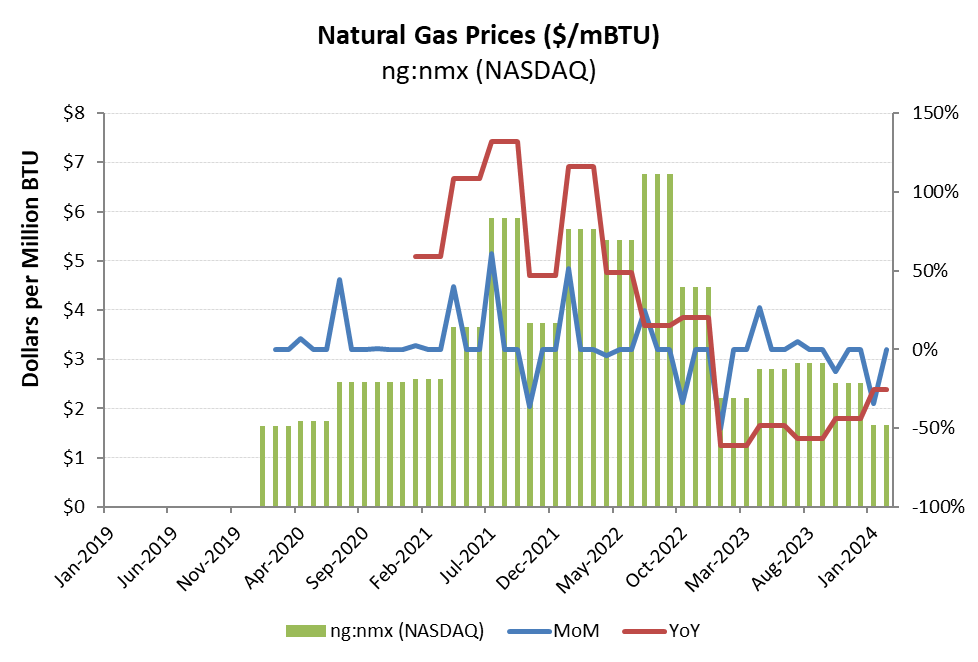

NatGas price spike in 2021

Stripe out energy & food, and ‘core’ CPI remains over double the +2% pa target rate

As with Mark Twain, reports of inflation’s “death are greatly exaggerated”. While tempting for markets to rush the ‘recovery’, purging over a decade of unfunded deficit spending from monetary expansion is not going to be quick or easy and much of the recent reductions in headline inflation numbers relates to the reversals in NatGas prices after the exceptional spike in 2021 & 2022 after the escalation of the Ukrainian/Russian conflict.

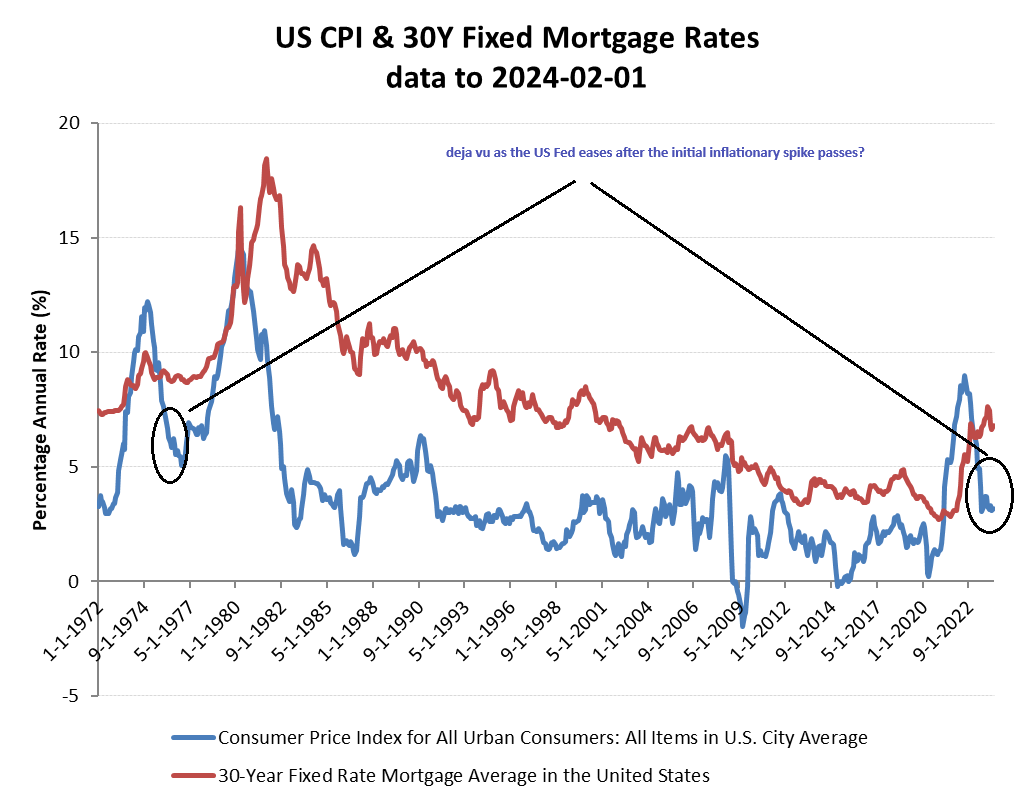

An obvious comparative of where we are today may be 50 years ago in 1974 following the reversal of the initial inflationary spike encouraged the then Fed chairman, Arthur Burns to ease monetary policy and thereby compound the subsequent inflationary increase and interest surge under his successor.

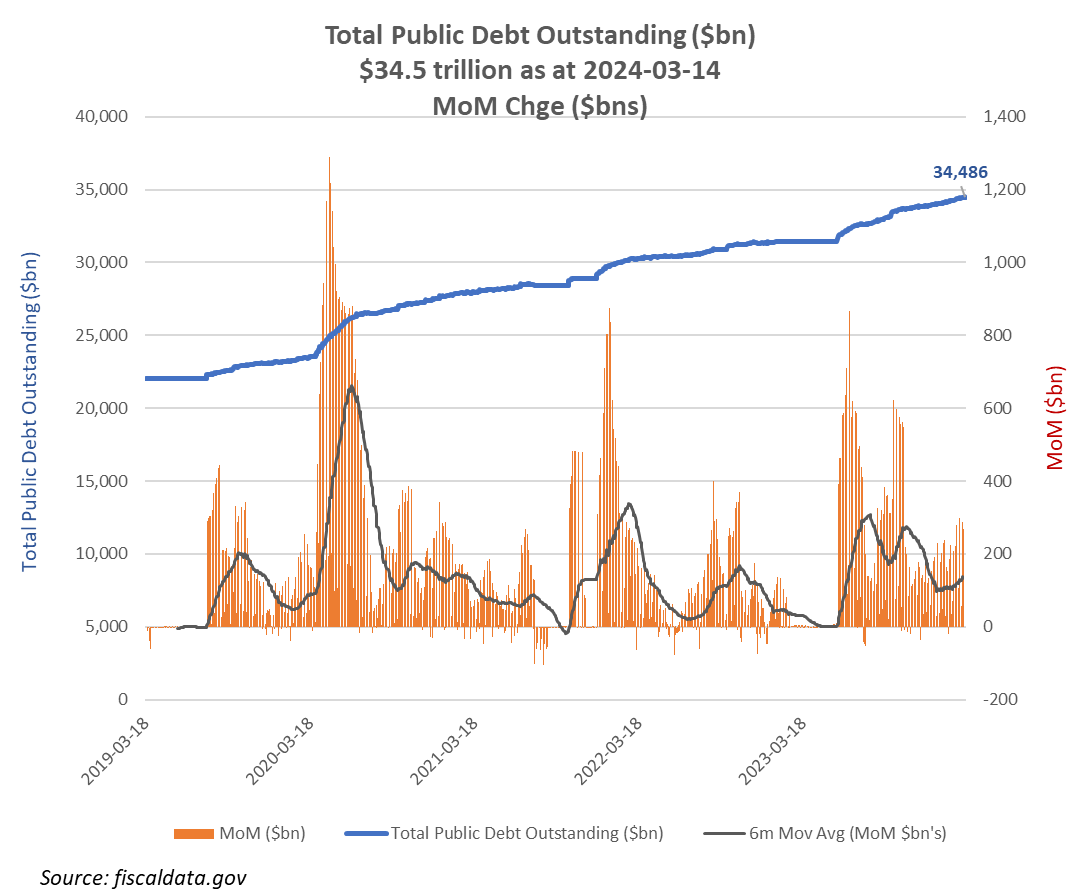

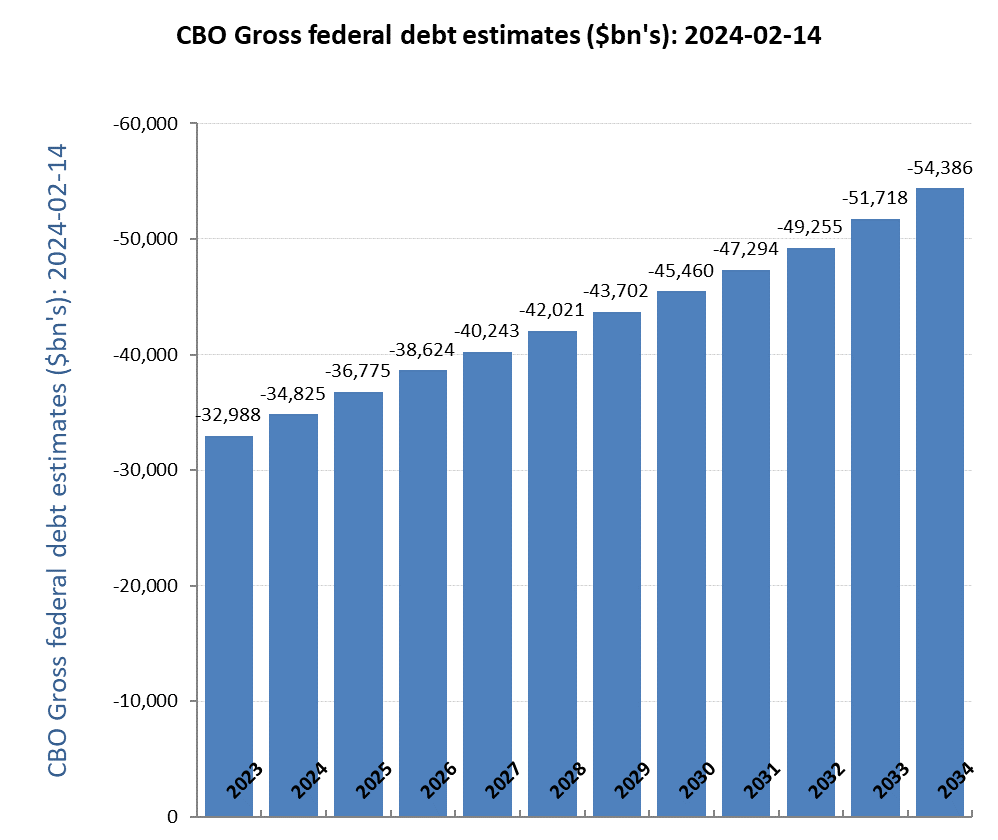

As I’ve highlighted before and is well understood by markets, US federal debt continues to soar, rising by almost $1tn per quarter. The fact that this is occurring during supposedly positive GDP growth, just suggests the latter is being funded by the deficit spending and therefore is unsustainable.

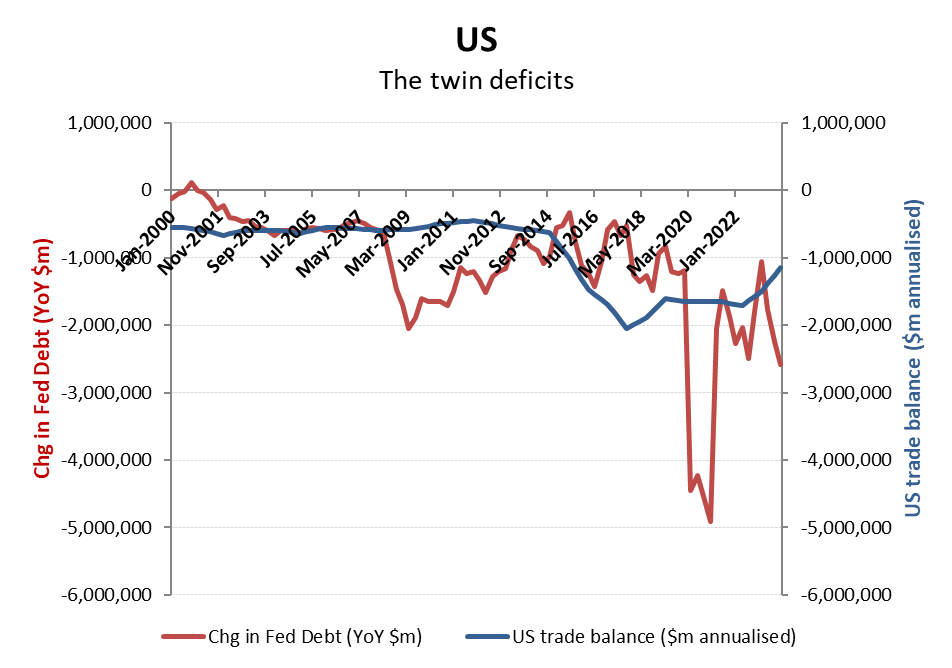

Running twin deficits (government and trade), meanwhile have never been a good idea for a currency, even when you used to be the reserve currency.

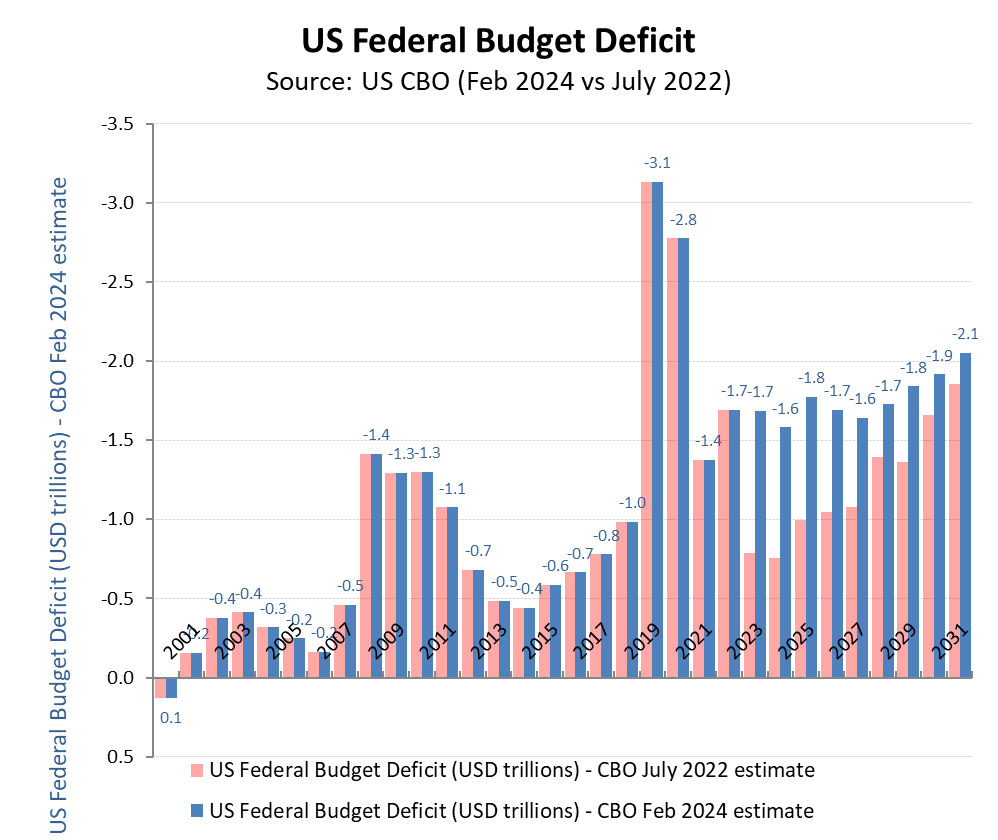

As if the exploding levels of US federal debt wasn’t a clear enough indicator, even the CBO has belatedly had to revise up its estimated deficit for the US federal government.

So if you thought >$34 trillion of federal debt wasn’t bad enough, the current trajectory is expected to take this to over $45tn by the end of the decade and almost $50tn a couple of years later. And on past form for CBO revisions, this is probably an optimistic forecast.

Conclusion?

Well either the USD is to enter a downward spiral of currency devaluation, inflation and interest rate increases as per the late 1970’s, or else a more fiscally responsible administration will need to emerge, which will also need to be accompanied by a more honest monetary policy, again as per what happened in the 1980’s under Thatcher & Reagan. Either way, medium term interest rates will remain elevated, which for those other central banks suggests a painful period of hangover also for themselves. Encouraging ones ‘allies’ to overextend fiscally as well as monetarily, only to then pull the monetary rug from under them seems rather tough, but then it might help remove those currencies as potential alternative to the USD reserve status!