United States can “certainly” afford to support wars on two fronts – Yellen

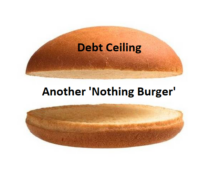

A runaway deficit already at around $2tn pa and rising interest rates as the US government is forced to compete for funds to pay for this and US Treasury Secretary Janet Yellen wants us to believe her administration can afford another war. For those bond funds already burned from believing her claims in 2021 that […]

Continue reading