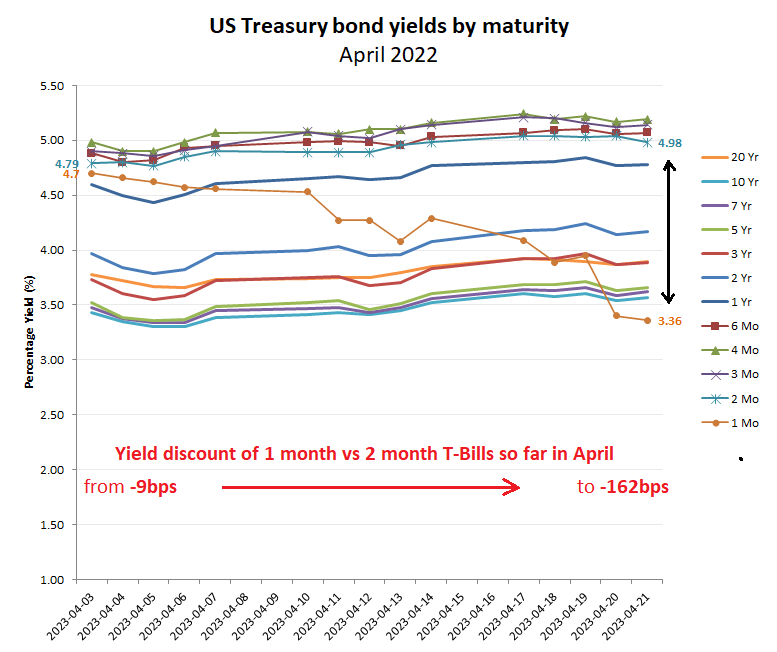

1 month T-Bill yield spreads expand by >160 bps in April – Signs of growing stress!

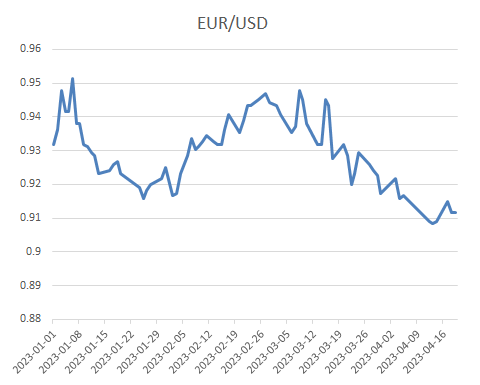

Whether it’s a flight to safety, a rush for USD collateral, or perhaps something else, the sudden divergence of the 1 month US T-Bill yields against the rising trend across all the longer maturities over the first three weeks of April doesn’t appear to bode well for markets. For the USD however, this may reflect the noisy declarations for de-dollarisition reflected the pain of a EuroDollar shortage which could well precipitate a reversal of the recent decline in the USD. And perhaps Warren Buffet felt he knew something ominous was brewing between Taiwan and China when he recently bailed out on his holding of TSMC.

Yield discount expands by over 160 bps in first 3 weeks of April on the 1 month T-Bills vs the 2 month

Scary things happening at the short end of the US T-Bill yield curve. Over the last fortnight the 1 month yield has diverged with the yield spread vs the 2 month T-Bill expanding by 99 bps from -9 bps to now -108 bps. As you can see from the chart yields across all the other maturities have been rising after the initial declines following the Fed emergency liquidity injection post SVB on the 16 March. This is a sign of extreme stress in the system and a rush for USD collateral by a market short of EuroDollars. Helps explain the renewed push for de-dollarisation, but also suggests a reversal in the recent decline in the USD.