June US employment running warm, rather than hot – albeit a bit of a red herring for US Fed rates

If yesterday’s 10 year yield bounce to over 4% was a function of a more aggressive further interest rate rise by the Fed this month after the June ADP figures, then today’s cooler employment estimates for June from the BIS in its non-farm payroll figures may help dampen some of those fears. All this however, remains largely background noise of heavily seasonally adjusted ‘guestimates’ against the real driver to interest rates being the forced debt issuances from most major central banks as inflationary pressures reverse previous balance sheet increases, as discussed in our previous post.

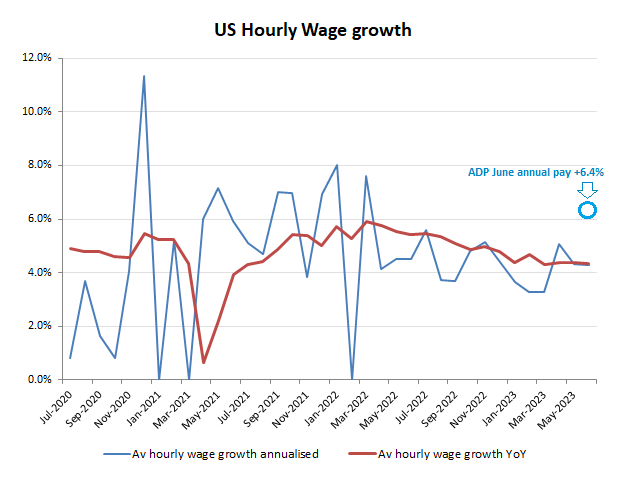

Yesterday’s ADP jobs report for June, estimating a MoM increase of +475k was around double the market forecasts, which with the estimated annual pay increase of +6.4% was suggesting employment markets were running a lot hotter than previously thought, with the inevitable read across to potential further interest rate hardening when the Fed next meets later this month (26-26 July FOMC). A couple of points however, may need to be remembered.

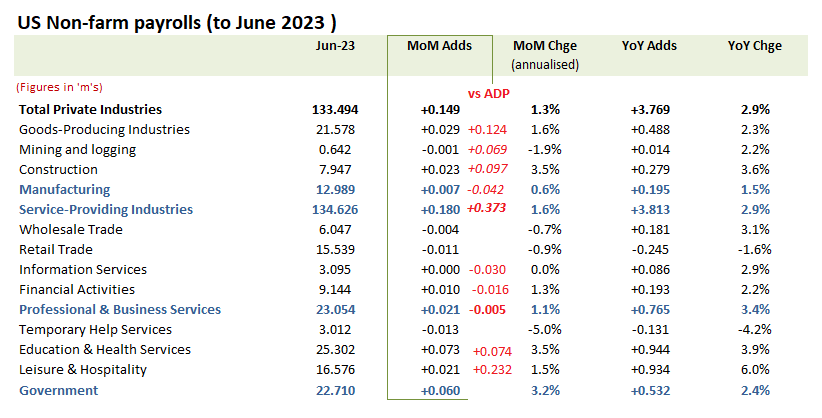

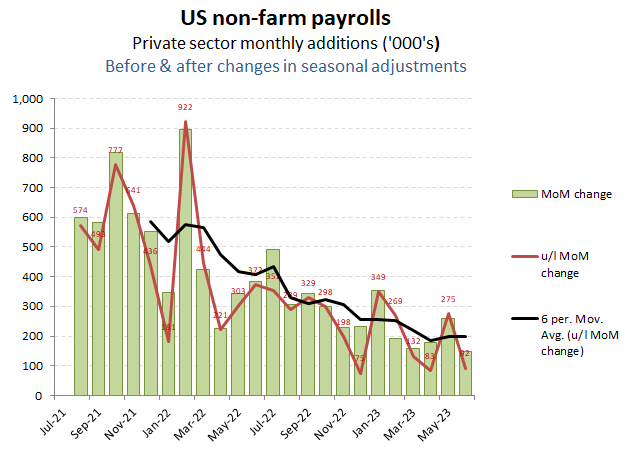

- Firstly, the mid-year and year end estimates are heavily adjusted for ‘seasonal’ factors, which for the June BIS numbers included a +57k increase in the adjustment to a still substantial adjustment of -895k , which clearly dwarfs to actual reported monthly increase of +149k for private sector monthly job growth.

- Secondly, even a cursory glance at yesterday’s ADP estimates should have alerted markets to the extent to which the Leisure and Hospitality segments had been responsible for the over-delivery, areas particularly sensitive to assumptions on seasonal adjustments. Other categories, such as with the modest advances for construction and stalling manufacturing were much more aligned.

Consistent with prior BIS monthly reports, the June NFP suggests a slowing, but still positive jobs market.

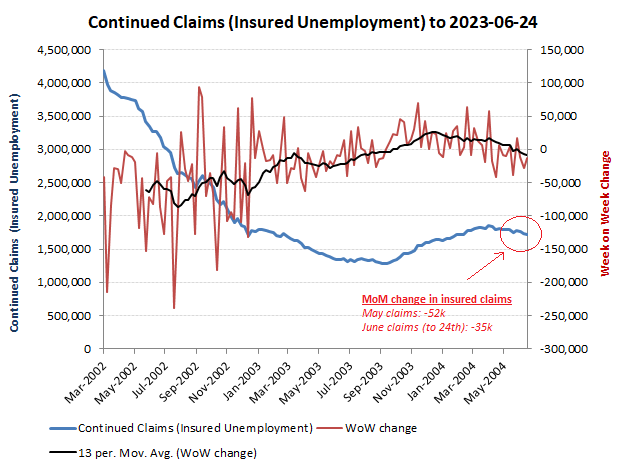

As always, we like to validate the BIS ‘guestimates’ with the harder data from the Bureau of Labor on weekly insured unemployment claims. Here, the latest data to the week ending 24th June also suggests a positive jobs market, albeit at a diminished rate, with monthly claims to date for June at -35k versus the -52k reported for May.

The modestly positive employment trend remains consistent with the weekly insured unemployment reductions

The area of greatest divergence meanwhile between the BIS and ADP has been on the estimates on wages. Here the BIS suggests these are continuing to lag inflation, while for ADP these are a couple of percentage points higher at an estimated +6.4%. At this stage it is difficult to reconcile this variance, particularly in light of the more aggressive jobs growth estimated by ADP in the lower earnings categories of Leisure & Hospitality.