- Home /

- John Fallon

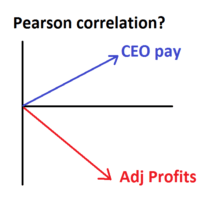

Pearson correlation? Cost cuts deflect attention from CEO remuneration

I am kicking myself over my stupidity. I should have anticipated Pearson’s CEO would find a bone to offer to shareholders over a contentious AGM which was voting, amongst other things, on the decision to award the CEO a +20% pay rise to a cool £1.5m for last year despite having to abandon profit guidance […]

Continue readingPearson defends the dividend and the shares bounce – as we had foreseen!

With a new Chairman on board and consensus forecasts for 2016 looking way too high, markets had started to doubt the group’s resolve and its ability to sustain the current rate of dividend. As it transpired, most of what we where suggesting yesterday has been matched by this morning’s release by Pearson (dividend, restructuring, restored […]

Continue readingPearson’s moment of truth – tomorrow’s 2015 pre-close IMS

Tomorrow Pearson will release its pre-close trading update for 2015 and markets are understandably reluctant to catch this falling knife before seeing whether the new chairman (Sidney Taurel) has dumped the CEO (John Fallon) and with him, his commitment to maintain the dividend (51p net in 2014 with a 34p final) as his “first priority”. […]

Continue readingPearson CEO buys more time by selling FT Group and Economist stake

Pearson is pricing in a +3.9% CAGR growth rating but has delivered only +1% organic revenue growth in H1 FY15. Deferred revenues however were up +3% organic at end H1, which if translated into similar improvements in H2 organic revenue growth would put the group on course to perhaps delivering +4-5% for FY16 and therefore […]

Continue reading