UBM/Informa merger revisited – surprised?

Having fallen out over the plum jobs back in 2008, UBM and Informa are back canoodling, with this mornings announcement of what is in effect Informa’s share and cash offer for UBM. In the intervening years, UBM has chased an earnings accretive, but growth dilutive acquisition strategy in US events while Informa has spun out the dogs and cut costs with its now completed “2014-2017 Growth Acceleration Plan”, albeit having restored organic sales growth to an under-whelming +3% for FY17.

So having tarted up the portfolios and returns, but delivered little in the way of restored organic growth, both companies have reverted to its original ‘plan B’; to revisit the original merger. While it is unlikely to resolve many of the key growth challenges in itself, it will however provide another opportunity to strip out costs, acquisition provision and further rationalise the portfolio. For Informa in particular, that should entail spinning out the low-growth, but cash generative Journals activities (to Springer?) as well as the struggling professional information activities (to Gartner/IHS Markit/RELX/DMGT/Euromoney ?), all of which should command some merger synergies and thereby be worth more elsewhere.

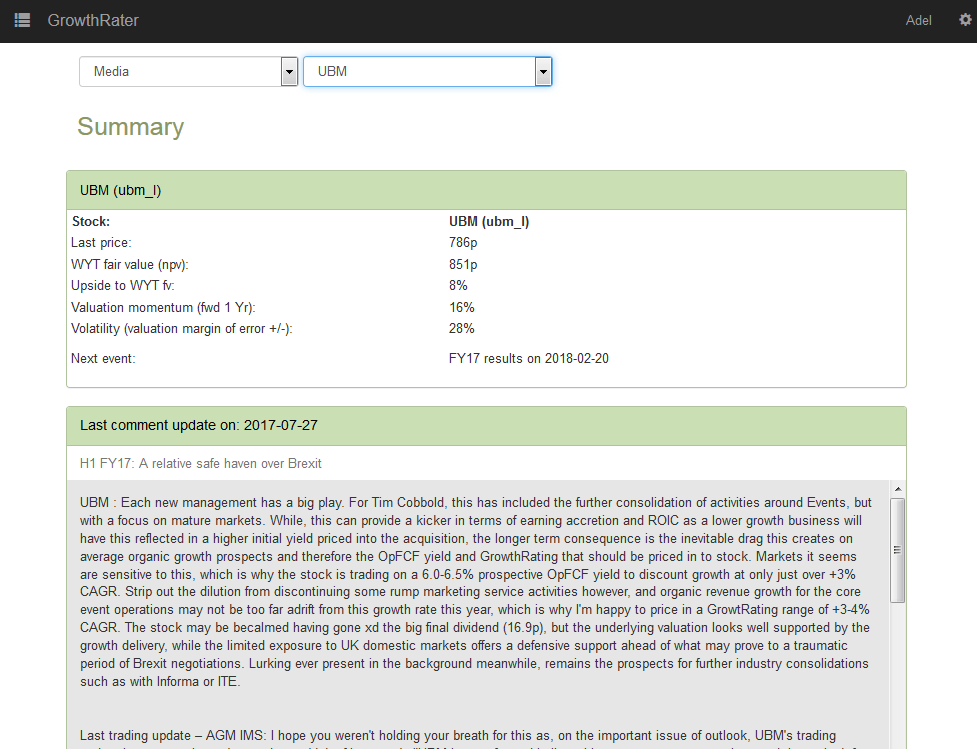

Plan B: It’s taken a few years, but this doesn’t come as a surprise, as I have written about on many occasions and why UBM was included in the GrowthRater portfolio.