Enterprise Inns: Asset play or just value trap?

Enterprise Inns (ETI): With a share price at an almost 60% discount to NAV, this may appear to be a compelling asset play, albeit this argument might have also appeared valid when the discount was 30%,40% or 50%. As with banks in 2008, a balance sheet asset is only as good as the credibility it has that it can either be crystallised and returned efficiently back to shareholders or that the level of assets are a true reflection of their capacity to generate future free cash flow streams. For Enterprise Inns, the NAV of approx. 250p per share meanwhile drops to nearer 230p ps excluding intangibles (largely acquired goodwill) and this is the sum of 680p ps (£3.8bn) of fixed assets (mainly property) against an approx. 450p ps of liabilities (£2.5bn; £2.4bn being net debt). Assuming that the liability part of this remains stable (ie the group not being hit by refinancing, closure or other provisions), then the excess fixed assets over liabilities is £1.3bn (230p ps) or just 34% of fixed assets. With falling beer sales, pub industry revenues are in decline and with it, so have pub property values. Indeed, although ETI has been booking occasional small exceptional gains on estate disposals, the overall position is one where impairment charges of over £0.5bn (approx. 90p ps) have already been recognised by it on its portfolio over the past 4 years alone. With financial repression artificially supporting residential property values, there is a potential alternative use value that could provide a support, although at this stage there is little way for external investors to determine what this might actually be.

As an ongoing business, ETI’s valuation as an equity will need to take into account the lack of organic growth, notwithstanding the high cash costs of maintaining and upgrading the portfolio and the approx. £300m pa of EBITA, but nearer £250m pa on a cash basis (post capital expenditure rather than depreciation).  With an EV of approx. £2.85bn, ETI is therefore currently priced at approx. 11x cash EBITA and a normalised Op FCF yield of around 6%; the latter implying an annual discounted growth rate of around +4.5% pa. Against organic growth struggling to get to even half this level and no dividend support, this would seem ambitious. In summary a potential asset play on presently undefined alternative residential use as long as financial repression can sustain absurdly low current buy-to-let yields in the South of England, otherwise a ‘value’ trap.

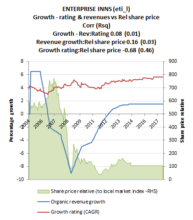

In the meantime, the enthusiasm of the NAV is obscuring the growth rating being afforded the business. After several years of heavy investment in sprucing up the portfolio, organic revenues are beginning to stabilise, but still to well under the implied growth rating of the overall group.

Perhaps, markets are missing the future growth potential and scope for over-delivery? While always possible, this however is not reflected by consensus expectations where earnings moment remains broadly flat to down across 2014 (see below chart).

So, what we have is a business that may or may not have a potential asset backing which may or may not ever get distributed to shareholders, which is carrying a heavy financial leverage that is being serviced from flat to falling cash flow from an ex-growth business model but has still managed to command a premium growth discount. Given the financial leverage, small reductions in growth discount have an amplified effect on the equity, so take the growth rating down by even 20% from the current +4.5% to even +3.6% and the equity component would face wipe-out!