Aegis (AGS-LN): Q1 beat on Revs + good momentum for 2012, but already in the price

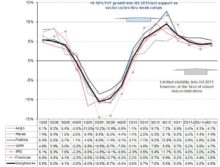

Q1 organic revenue growth of +8.1% was ahead of our +7.5% forecast; albeit below the +12.0% advance in Q4 2012, but in part reflecting a -3ppts less favourable prior year comparative. By region, The Americas were the high point, increasing organic revenues by a class beating +20.2%, and this even before the $2.5bn GM account starts to kick in (est from Q2). AsiaPac at +12.5%, was OK, given the Australian exposure (nothing on this in      the statement) and growth from China was reported as “strong”. EMEA however lagged at only +1.7%, reflecting the groups heavy European exposure. Beyond the north/south divide the group has not detailed the performances of its individual territories yet. Net new business came in at an impressive $2.9bn and included the $2.5bn US GM media account (from Publicis)

Outlook: GM contract should come on stream from Q2 and given the existing positive momentum there is no surprise at the groups confidence about its 2012 prospects. For FY12 we are forecast organic revenue growth of +8.6% and EBITA margins of 18.5% and diluted EPS of 12.4p.

Valuation: Aegis is delivering the fastest organic revenue growth in its class and with GM kicking in from Q2, this is only going to get stronger. This however is not unexpected and the group still needs to demonstrate that it has not chased revenues at the expense of profits in this instance. At current levels, we estimate the shares trade on an operating FCF yield of 6% for FY12, rising to almost 7% for FY13 to discount  growth of approx +5% CAGR; the upper level of their historic  growth rating range. Sure, the ever present bid talk surrounding Bollore’s 29% stake persists and at some point we expect him to put the group into play. Whether Publicis or WPP are willing to play ball this time now that they have already bolstered their media buying and digital marketing portfolio’s remains to be seen. Given the recovery in the Aegis share price and the group’s exposure to Southern Europe (especially France and Spain) the group is now longer the compelling target it may have once seemed.  With signs of weakness now also emerging in Australian advertising expenditures (Seven West Media shares shed -16% as it cuts forecasts), the shares are looking fully valued.

Aegis (AGS-LN)

Share price                                        174p

Growth rating FY14Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â +3.7%

Revenue CAGR FY12-14Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â +6.9%

Target CAGR (FY3)Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â +4.2%

Target price                                        168p

Upside                                                   -3%

Recommendation:Â Â Â Â Â Â Â Â Â Â Â Â Â Underperform

Agency organic revenue growth by quarter (YoY change)

Growth Rater Analysis