Gold & Gold miners – when to buy and how to value

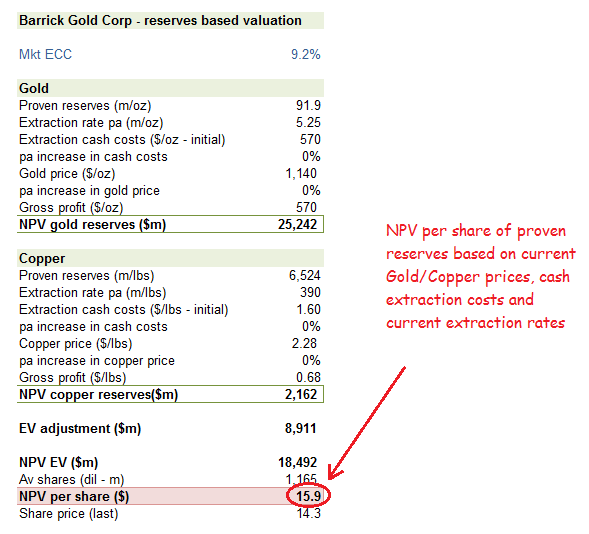

The gold price might be troublesome to predict, but at least the relationship between this and the share price of gold miners such as Barrick are proving to be more reliable. Back in July when I initiated coverage, I suggested markets were applying what seemed to be a ridiculously simple valuation methodology. Forget IRR with its arbitrary assumptions of reinvestment returns and fade rates, what markets seem to be doing, is just taking the NPV of the prospective cash profits from the current proven reserves based on the current rate and cost of extraction and more importantly, the current price of gold. While such a methodology ignores any opportunity value from the management, the record of impairment write-downs from less than successful acquisitions makes this a perhaps not entirely unreasonable proposition. By extrapolating an ‘as is’ environment as a permanent state however, the markets are also opening up a value opportunity for those wishing to anticipate change, particularly given the valuation leverage inherent with these miners to the underlying gold and copper prices. In the case of Barrick, the leverage of the shares to the underlying gold price is around 1.2:1 with the recent share price movement faithfully tracking the sensitivity matrix I published back in July

www.growthrater.com/valuing-gold-stocks-start-barrick-gold

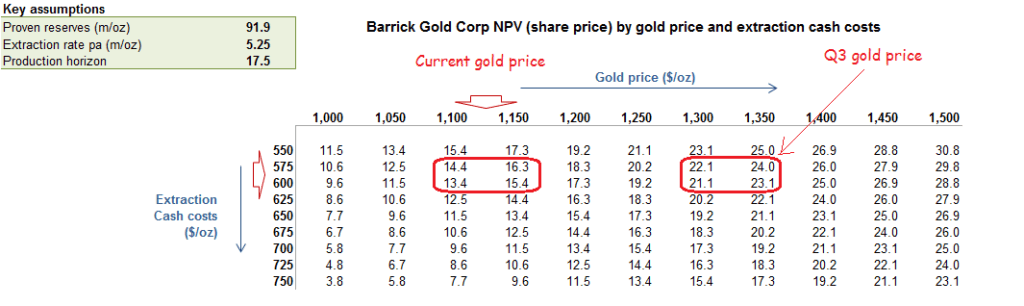

Below I have reproduced the current version, which is broadly unchanged except for the red arrow is pointing to a current gold price that has slipped back to under $1,150/oz rather than the almost $1,350/oz it was trading at in July. Unlike for Ashanti, Barrick’s extraction cash costs have remained relatively constant over the period which makes the share price sensitivity to the subsequent reduction in the underlying gold price particularly accurate.

A reserves based valuation for Barrick based on the NPV of its Gold & Copper proven reserves at current metals prices and rate and cash cost of extraction.

So where might the gold price go?

Well, there are no shortage of pundits and gold bugs out there with a view, but the first thing to remember is that without a yield or underlying consumption, there is no classic way of calculating its intrinsic value. As a store of value, there is only the perception of its worth derived from its historic role as currency, its limited new supply or average cost of extraction. What is perhaps easier to anticipate are its relative movements as a hedge against inflation, fiat currency debasement or other forms of state seizures of private assets. Financial repression from lower yields as governments monetise deficits by buying in their own debt had increased the relative appeal of gold as a safe haven to currency debasement, although the more recent expectations of a policy unwind which has driven up yields and the appeal of holding US dollars versus other currencies and asset classes such as gold. The big question however is whether this does indeed represent the beginning of the ‘great unwind’ or is merely theatre ahead of another round of inevitable debt monetisations which will again drive assets back into safe haven precious metals. If you believe either the US unemployment rate or the last set of US GDP statistics represent a true picture of improving economic recovery that warranted not only this months +25bps interest rate increase by the Fed, but the further 3-4 further similar increases forecast over 2017, then one can understand why cash has been invested out of ZIRP assets like gold and ZIRP currencies such as the Yen and Euro into US dollars. One might also wish to put out a glass of milk and biscuits for Santa as well.

If rates rise, it won’t have anything to do with the US jobs data

The idea that the Fed has had a Pauline conversion to sound money to head off inflationary pressures from an over-heating economy however is laughable. If rates are being mainly talked up again, it is for the very same reason that it was done last year. That is in order to maintain demand for US dollars ahead of more debt monetisations. Politically, Trump also needs to demonstrate the need for his stimulus plan and to do this, GDP expectations need to be culled, but not due to his management. An interest rate rise enacted under his predecessor, with debt laden consumers frightened off with threats of more rate rises to come fulfils this perfectly. If one hadn’t noticed, the level of government and personal debt will make a re-run of Reaganomics a difficult act to repeat and Trumps stimulus plans will need be be deficit financed, at least initially. Would he like to borrow in the bond markets with a counter-productive further increase in interest rates or revert to to QE? Wait for the signs of slowing consumption as saving ratios are re-built into the expected rate increases and this may provide the first signs of retreat on monetary tightening and therefore the potential trough in gold prices.