>Magic money

>

Graduates of the Hogwash school of financial wizardry are forever trying to cook up new ways of creating apparent value out of nothing. While their stratagems may vary considerably from the crude currency debasements such as quantitative easing or Ponzi schemes to more complex accounting manipulations and derivative structures, they often have a common thread; an apparent risk arbitrage. At a basic level this would equate to carry trades with a miss-match in maturities and risk. These exist because while in the real world markets are attuned to price in the different risks associated with these gaps, these may not necessarily be captured in reported accounts or broker valuations. One such carry trade is company financial leverage which can exploit the market’s fixation with the nebulous concept of Earnings per Share and Price earnings multiples and the assumption that capital structure can determine valuation which can be exploited to enhance a firm’s apparent net worth. The Capital Asset Pricing Model (CAPM) which uses a Weighted Average Cost of Capital (WACC) as the denominator to calculate a Net Present Value (NPV) to suggest similar valuation accretion often falls into a similar trap. That is, it assumes that markets do not price in an additional risk premium on to debt, over and above the average servicing costs. Numerous studies on share buy backs (see footnote) however suggest that this is not the case and that replacing equity by debt does not raise the overall enterprise value, notwithstanding the EPS accretion. This broadly supports Miller and Modigliani’s theoretical propositions on capital structure in 1958 that barring the benefits of the tax shield, an overall valuation was unaffected by the mix of debt or equity financing; or to use a food analogy, that regardless of how you slice a cake, its overall size remains the same.

Earnings based valuations

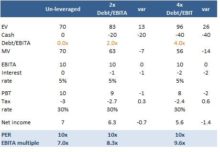

Even if one were to assume that the earnings numerator is calculated on a consistent basis and fully reflects underlying cash flows (ha ha!), an earnings based valuation model still has a number of flaws that relate to capital structure. A relative rate of EPS growth might be related to a longer term PE relative, with a relative risk premium possibly guestimated on the basis of past levels at similar points of the economic cycle. Balancing the impact of higher leverage on financial risk and EPS accretion however is more problematic as the below example highlights. In this, I have postulated a company at three levels of financial leverage, with similar rates of EPS growth and the same valuation of 10x earnings in all cases. In the base case, the unleveraged business generating 10 of EBITA and 7 of net income (after tax at 30%) is therefore valued at 70 (both EV and MV) or 7x EV/EBITA. On the second scenario, 20 of debt raised for a share buy back (29% of MV) financed at 5% would cut net income by only 10% and MV by the same rate and by 7, assuming an unchanged multiple of earnings. The overall value of the enterprise including the 20 dispersement however would rise by 13, from 70 to 83. Increase the buy back up to a 4x debt/EBITA multiple and the EV rises by 26 or +37%. On an EV/EBITA basis meanwhile, the valuation rises across these scenarios from 7.0x to 9.6x. If one truly believed that the additional financial leverage is not costing more than its accrued rate of 5%, then share buy backs would be a no brainer. They are certainly appealing to management as a quick fix for EPS. In the 4x debt/EBITA scenario, if 40 was raised and returned back to shareholders, it would reduce original 70 of equity to only 30 (-57%). Net income however would drop by only 20% which would equate to a massive accretion in EPS (on the smaller equity base of +87%. Adjusting for the additional share dilution from EPS related stock options however may be another matter!

|

Buy back scenarios

WACC’ed Applying a WACC based valuation model would provide very similar results to the PE model in the above share buy back example. On the unleveraged example, the unleveraged earnings is discounted by 10% (a 10% earnings yield and 10x PE multiple) to arrive at the MV and EV of 70. On the 4x Debt/EBITA scenario, debt weighting rises from zero to 42% of EV, which reduces the WACC from 10% to 7.3%; a reduction of 27%. This is greater than the reduction in post interest earnings with the consequence that the MV actually rises by 7/+10% to 77 while the EV increases to a somewhat aggressive 117, an rise of almost 70%. No wonder analyst DCF valuations tend to be so ambitious.

|

Do share buy backs work?

There has been a number of studies on this as well as enough anecdotal evidence (such as from BHP Billiton’s -3% initial share price fall after announcing its monster $10bn buyback), to suggest that buy backs are not value enhancing despite their EPS accretion and appeal to EPS based compensation schemes. Some of these include:

November, 2007 study by Standard & Poor’s Equity Research examined 423 companies in the S&P 500 that reported share repurchases over the past 18 months. Only one out of every four, or 103 companies, outperformed the index after reporting the buyback, the study found. “The companies that used buybacks most aggressively actually generated the weakest returns over the course of the study period,â€

//dividendsvalue.com/1115/share-buybacks-do-they-really-help/

2009 study by Professor of Management at Graduate School of Management, University of California, on “Accounting Rules? Stock Buybacks and Stock Options: Additional Evidence†Summary “while investors respond positively to a buyback announcement, the presence of higher option value and higher CEO compensation moderates that response. Investors also experience a reliably negative return from 90 days before to 90 days after the announcement, other than a 1.78 percent three-day announcement effect. In other words, while managers might expect a buyback to bolster lagging pre-buyback shareholder return, this strategy does not seem to work for recent buybacks, at least within three months following the announcement.