- Home /

- Economics

Played again?

Are we being played, yet again? Markets have been suggesting as much since the start of the year, with gold soaring, the USD wilting and US treasury yields edging higher. The penny seems to have dropped even for Elon Musk as Congress tries to push its pork filled funding bill while failing to incorporate any […]

Continue readingFollow the money

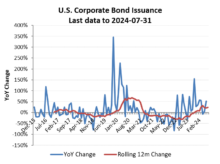

Back in August of last year I highlighted the seemingly incongruous activity of corporate treasurers who had been raising record levels of new debt from bond issuances, notwithstanding the prevailing market ‘wisdom’ and recomendations that interest rates could only fall from those prevailing levels. Well, with long end bond maturies rising, including an approx +50bps […]

Continue readingSitzkreig

Today’s headlines may be celebrating the recovery in US jobs numbers in November (or at least the BIS’s ‘non-farm payroll’ guesstimate), but the reality may that we are just seeing the month-on-month distortions and knock-on effects of goosing the pre-election report for September which seem to have come out of the October figures. In that […]

Continue readingGoosing US jobs data, before it gets cooked next month!

Now that’s a surprise, an upbeat job growth (gu)estimate released by BIS, in its last update before the November elections. One might almost think they are trying to apply some lipstick to ‘Bidenomics’ to avoid the prospect of their own jobs being culled by that prospective DOGE grim reaper, Elon Musk. What may be less […]

Continue readingDOGE ball

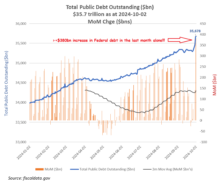

Can the USD be saved? Given the trajectory in Federal debt and deficits and apparent reluctance of the Uniparty to extract their snouts from the public trough that seems unlikely. Indeed, the assumption that inflation and debt monetisation will continue to define US Treasury policy is the defacto consensus opinion within financial markets and as […]

Continue readingAnother ‘conspiracy theory’ bites the dust?

After lies, damn lies and statistics, government ‘estimates’ such as the BIS’s monthly guesstimates for non-farm payrolls must rank as one of the more unreliable economic datasets, particularly in the run up to a quadrennial election year in the US. While also undermined by the debt fueled life support currently being administered by the incumbent […]

Continue readingIf rates are expected to fall, why the surge in corporate bond issuance?

If ‘everyone’ believes interest rates are going back down, then why was US corporate bond issuance up +54% YoY in Q2 and with the high yield/junk end the most active? Seems like corporate treasurers were happy to unload some extra debt to “willing buyers at a fair market price” as Jeremy Irons character ‘John Tuld’ […]

Continue readingMarkets play chicken with the US Fed again

Markets are down as a sense of fear grips investors. That however, has less to do with a sudden re-evaluation of the economic outlook following the release of the US employment survey data for July and much more to do with a growing panic that the US Fed is resisting the pressure to be bounced […]

Continue reading