Pearson disappoints (again) and resorts to the old trick of dropping the adj tax rate

Pearson:  Another update (Jan trading statement) and another slippage in underlying expectations as US educational markets continue to decline and with even the 70p per share FY13 guidance relying on some exceptional massaging of the ‘adjusted’ tax rate. Without an early turn in this market cycle and Pearson’s own internal investment programme unlikely to deliver until 2015, there seems little reason to ride the shares when they are already discounting over +4.5% CAGR and the group’s own medium term organic revenue outlook.

Trading: Co is forecasting (23/1/2014) FY13 reported EBITA of £735m, which excluding the estimated -£130m of net restructuring costs implies a gross EBITA of £808m and a -3%/-£25m decline on 2012’s restated comparative. In the US, both K12 and HiEd markets remain under pressure (state budgets and the move to “Common Core†for the former and lower enrolments and squeezed for profit colleges squeezing the latter. At the FT however, rising digital subscriptions continue to more than offset weak advertising and lower print sales. For FY13, the Co estimates adj net interest of approx -£65m and therefore adj PBT of around £670m (vs £769m for continuing Ops in 2012). After a £29m tax credit from Penguin, the Co is forecasting adj EPS of 70p ps, therefore c.£567m of net income and an adj tax charge of only -£103m. Add back the £29m relating to Penguin, tax therefore would have been approx. -£132m, implying an underlying tax rate of under 20% vs previous expectations and an H1 rate of over 24%.

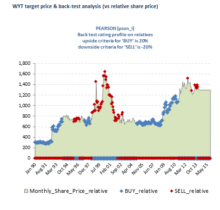

A +4-5% growth rating range remains justifiable for this group, but with current organic revenue growth running at half this level and facing a build-up in new product investment that may prove more protracted than markets expect, we would expect the shares to remain nearer the lower end of this range.

(Jan 2014)