- Home /

- adjustments to seasonal adjustments

US jobs data for May – real trends now being allowed to show through

Is the BLS letting markets down gently that the US economy sucks and to kiss goodbye to a rate hike in June? Beyond the boost in February from renewed shale fracking and an exceptionally mild winter (on mining and construction job formation), US job growth into 2017 has been dire. I’m not referring to the […]

Continue readingApril Non-farm payrolls: how to turn +76k jobs into +194k

This is feeling like Groundhog day. Another monthly jobs report by the Dept of Labor showing strong employment growth and triggering a wall of narrative from the markets proclaiming the next rate rise like the second coming, but another conclusion based on what Trump might describe as ‘fake news’. Were those who predicted April MoM […]

Continue readingTrump and hot air lift February US jobs data – but will this be enough to justify a rate rise?

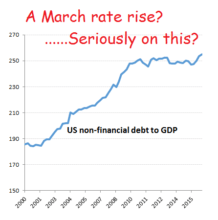

Does anyone not expect a March rate increase? After raising its Q1 GDP estimate from +3.09% to +3.19%, the +227k net private sector job adds reported in yesterday’s non-farm payroll data for February (after the +298k already reported mid-week by ADP), coming after similarly buoyant data released for January, the Fed seems to be setting […]

Continue readingAdjustments to seasonal adjustments ‘add’ +101k jobs to December’s reported non-farm payroll figure

+144k net private sector job additions in December may a little below the trend, but with the previous two months revised up by +53k, this is probably where most of the headlines will stop, although Fed diehards may also point to the further rise in average hourly wages to a ten year high of +2.9% […]

Continue reading