- Home /

- Author's Archive:

Another ‘conspiracy theory’ bites the dust?

After lies, damn lies and statistics, government ‘estimates’ such as the BIS’s monthly guesstimates for non-farm payrolls must rank as one of the more unreliable economic datasets, particularly in the run up to a quadrennial election year in the US. While also undermined by the debt fueled life support currently being administered by the incumbent […]

Continue readingCar industry goes soviet

“The new car market is no longer a market, unfortunately. It’s a state-imposed supply chain.”Robert Forrester, Chief Executive of Vertu Motors (UK) Unfortunately, this is a bit like noticing the iceberg after not only hitting it but realising that there aren’t enough life-rafts. At present, the car industry, including dealers such as Vertu, are reporting […]

Continue readingWhen the party stops

When the party stops The parallels between this cycle’s tech wunderkind, NVIDIA and yesteryear’s CISCO are not new, but worth repeating. As no group can out grow the market in perpetuity, the question always remain as to how far out will markets choose to reach out into the uncertain future to fix their horizon values. […]

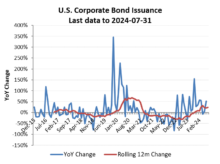

Continue readingIf rates are expected to fall, why the surge in corporate bond issuance?

If ‘everyone’ believes interest rates are going back down, then why was US corporate bond issuance up +54% YoY in Q2 and with the high yield/junk end the most active? Seems like corporate treasurers were happy to unload some extra debt to “willing buyers at a fair market price” as Jeremy Irons character ‘John Tuld’ […]

Continue readingMarkets play chicken with the US Fed again

Markets are down as a sense of fear grips investors. That however, has less to do with a sudden re-evaluation of the economic outlook following the release of the US employment survey data for July and much more to do with a growing panic that the US Fed is resisting the pressure to be bounced […]

Continue readingSomething fishy with official US employment data

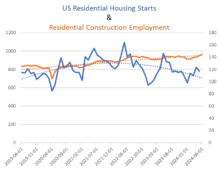

US residential construction can slightly lag private housing starts, but never to this extent. Either the US residential construction industry has become a lot less efficient (as in the ratio of employees needed to build the average house), or there’s something increasingly fishy with the official BIS employment data.

Continue readingIs the ECB being hung out to dry?

Has the US BIS not got the memo to support the easing narrative with softening economic data, or is the ECB and Euro being hung out to dry? For those hoodwinked by the manipulated GDP deflator assumptions (see below) between Q4 2023 and Q1 this year, into over-estimating the slowdown in economic activity must have […]

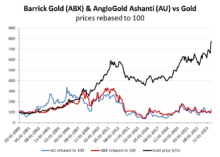

Continue readingSoaring gold prices and gold miners

As markets lose faith in the Fed’s ability to manage its easing pivot, gold and silver prices are soaring to new records notwithstanding hardening long bond yields. For investors wanting to participate in this trade, the choice seems to be between physical gold bullion, paper gold certificates or those mining the stuff. Those with a […]

Continue reading