- Home /

- Internet

Q1 Agencies Postscript

The City narrative on the Q1 results seems predictable enough; a positive underlying revenue momentum which is encouraging managements to raise full year trading expectations and return to acquisition led expansion – a big hurrah for the bankers! Equity markets however are proving a tougher nut to convince, given its broader macro focus and as a consequence consensus forecasts for revenues […]

Continue readingPublicis Q1 – positive revenue momentum, but is this the real story?

The narrative the markets will focus on will remain the group’s ability to translate its digital and emerging market investments into premium revenue growth and further margin progress. From this perspective, Publicis’s Q1 revenue performance should be well received. A +6.5% rise in organic revenues pipped Omnicom’s +5.2%, reflecting continued progress in digital (+12.6% to 28.2% of revenues) and […]

Continue readingOmnicom Q1- EPS flattered by FV adjustment

Revenues on track, but FV adjustments flatter margin and EPS beat Delivering Q1 EPS of $0.69 vs a consensus expectation of $0.59 ($0.56-$0.63 ranged vs $0.52 for Q1 FY10) seemed like a fairly convincing beat, although the market had not been expecting the $123.4m of book gain from the remeasurement of the fair value of […]

Continue readingQ1 Previews – Agencies

Today’s Q1 results from Google provides a prelude to Q1 reporting season for the marketing services groups which kick-off next week (18-22 Apr) with Omnicom which reports on Tues 19th and Publicis on Thurs 21st. The following week IPSOS reports on Tues 27th with WPP and Interpublic on Thurs 28th. With Q4 recovery momentum already reported to have […]

Continue readingFinally a media example!

All very interesting you might say, but isn’t this a ‘media’ blog? Indeed it is, but just as any great sauce needs to be based on a good stock (yes I spent the best part of a decade at a leading French bank), so a meaningful media valuation needs to be rooted in a coherent and […]

Continue readingEarnings to FCF in pictures

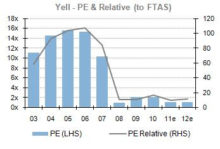

Before I start to drill down into how a market ECC can be used to translate company FCF yields (operating) into growth ratings, I thought a few parting shots at the PE merchants was in order. If you’re seriously trying to explain equity valuations on the basis of reported earnings please consider the following 7 […]

Continue readingRisky business

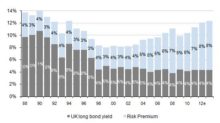

If something happens a lot, then a few bright sparks may deduce that the probability of it happening again will have gone up. It was on this theme and with reference to the longer term outperformance of equities vs bonds that a number of equity strategists were arguing for a structural decline in the equity […]

Continue reading>Magic money

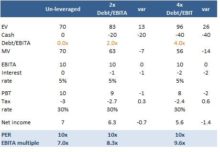

> Graduates of the Hogwash school of financial wizardry are forever trying to cook up new ways of creating apparent value out of nothing. While their stratagems may vary considerably from the crude currency debasements such as quantitative easing or Ponzi schemes to more complex accounting manipulations and derivative structures, they often have a common […]

Continue reading