Facebook: Q1 beat followed by controlling shareholder share sale – ring any bells?

Facebook shares had a good bounce on its blistering Q1 results which, oh so conveniently, accompanied its announcement of a stock split into new non-voting C class shares. This is a similar ploy the one Vere Rothermere used a few years ago with the DMGT scrip issue as a way of enabling him (well at least his son by then) to sell down his stake while retaining voting control.

My concern however, has less to do with with shareholder rights than the timing. As with Badinter’s stake sale in Publicis last year, which was preceded by an upbeat guidance, that was subsequently missed, the proposed Scrip issue is to facilitate a partial disposal by Mark Zuckerberg. While it might be difficult to believe that someone with such selfless generosity to give most of it away to charity (his own that is) might take advantage of such a fortuitous pick-up in expectations, there are a couple of concerns I have with regards the consensus forecasts, rather than the valuation.

- News Feeds adverts generate considerably higher click-thru rates than side adverts and are better suited for mobile. The rise in mobile usage means more News Feed adverts and therefore more clicks and thus more income for Facebook. What isn’t talked about so much is that conversions are a lot lower and this is what advertisers are really buying. Watching Facebook billing you for clicks while conversions drop is not a good incentive to encourage SME’s too keep growing their budgets. While I await the big agency survey to tell me otherwise, I shall go with my own channel checks which suggest some less than happy Facebook marketers in Q1 who are cutting budgets on this platform until conversions recover. What is interesting is that a careful reading of the Q1 results and conference call reveals that Facebook is already cautioning markets not to get too carried away on its revenue forecasts; to expect North American ARPU growth to slow and cautioning about revenue growth as the group cycles against increasingly tough prior year comparatives.

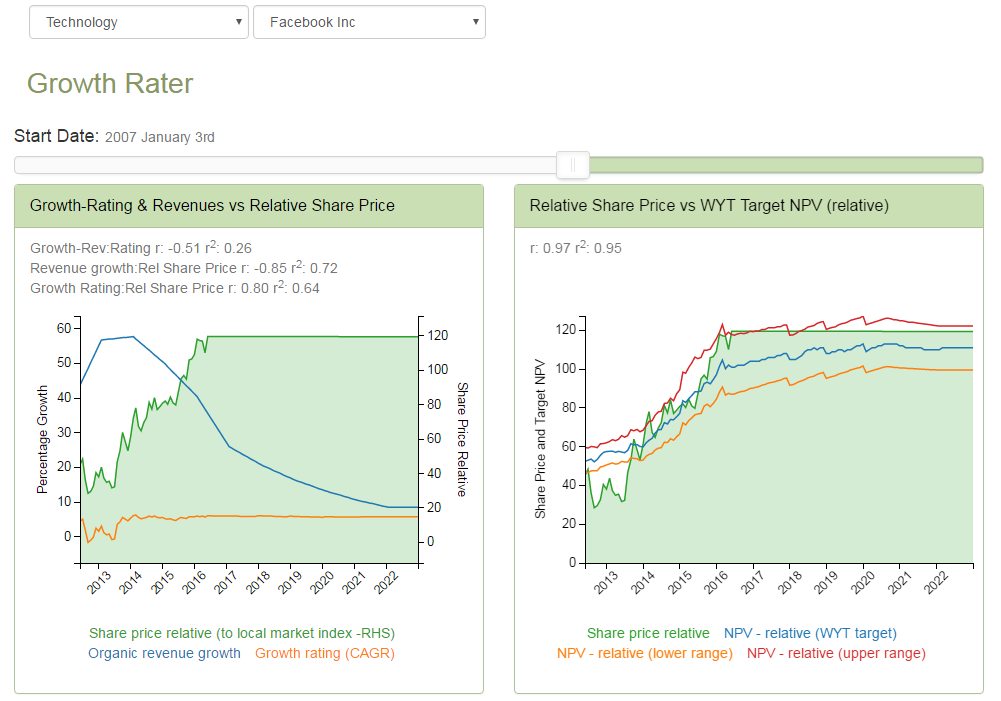

- Markets seem fairly oblivious to this, with a FY16 consensus revenue forecast to rise by +46% to $26.2bn with a further +33% projected for FY17 (to $34.7bn). For FY16, this implies a growth of approx +44% is being anticipated for the remaining 9 months of this year. Against the +52% delivered for Q1 (+50% without the additional week), this might not seem that unreasonable, until one realises that Quarters 2-4 will be cycling against a prior year revenue growth of +44% vs the +28% achieved for Q1 FY15. Consensus revenue forecasts for FY16 are therefore anticipating an underlying drop of only -5ppts in the rate of growth in revenues over the remainder of this year, notwithstanding an approx 28ppts of additional comparative headwind. Even excluding the concerns of marketers from out first point, this might seem aggressive! My issue here is not the markets valuation of Facebook, but the consensus forecast base on which it appears to have been made. If I were to plug in a comparable revenue outlook into my model, the impact on Op FCF and forecast horizon would push the valuation up to if not slightly beyond where the share price is currently (- see the mean reversion tab (“Horizons”) or adjust up the revenue outlook in “Sensitivities” in the web app https://app.growthrater.com/). The problem is that these top line aspirations look vulnerable, which for a ‘super-normal’ growth stock can be an expensive place to be.

Valuation is consistent with consensus forecasts – How accurate they are is another matter!