- Home /

- 10 year bond yields

Bond yields are rising, but more importantly normalising

Bond yields are rising, but perhaps more importantly, they are also normalising. Yields are rising, not because inflation rates are higher, but because of liquidity imbalances between borrowers and lenders. Where inflation fits into this process, is as a catalyst for returning the pricing of capital back to markets by removing the headroom of central […]

Continue readingZero bond yields are not without a cost. Mind the Gap!

Interesting article yesterday on Bloomberg reporting that billionaire Stan Druckenmiller has dumped equities in favour of US treasuries, where he sees 10 year yields dropping to zero over the next 18 months. The two big assumptions however, is that Trump won’t get re-elected in 2020 and that US yields will converge down to those in […]

Continue readingWar by other means – interest rates

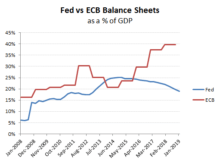

War by other means? Forget the South China sea, Syria or Korea. If you haven’t noticed, the EU and China are locked in a high stakes game of chicken with the US over control of the World’s reserve currency, where the weapon of choice are interest rates. While much has been made of Trump’s attempts […]

Continue reading