- Home /

- Equity Risk Premium

Are equities expensive?

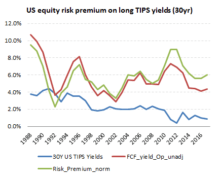

The spike in US bond yields has implications for equities, but perhaps not as directly as one might imagine. Yes, long bond yields and particularly TIPS, provide an effective proxy for a risk-free return and therefore the essential anchor for valuing other asset classes, but only from a relative rather than absolute perspective. It may […]

Continue readingAre equity markets expensive?

This is a regular question posed by investors and market commentators, but in many ways is also the most meaningless. This is because the relative merits of equities as an asset class owes more to the ebb and flow of liquidity to goose demand, rather than some theoretical notion of a ‘correct’ valuation that should […]

Continue readingWhat equity valuations might be trying to tell you!

Hang on, according to the ‘experts’, this wasn’t supposed to happen! Having been fed a diet of gloom by everyone from Hedgies (Bridgewater), Academics/Economists (Dartmouth/MITI/Krugman), Banks (Citi) and wealthy investors (Mark Cuban – see end for links) should Trump get elected, markets have done what they do best and confound the experts, with US equity […]

Continue readingLooking beyond central bank interference in equity valuations

Behind the incessant background noise of Yellen’s ‘will she won’t she raise rates’ discussion, the closing of the Q1 results season provides a good opportunity to take stock of the broader earnings and more importantly OpFCF yield basis on which equities are priced. Relative to expectations at the start of the year, there have been […]

Continue reading