- Home /

- interest rates

Looking beyond central bank interference in equity valuations

Behind the incessant background noise of Yellen’s ‘will she won’t she raise rates’ discussion, the closing of the Q1 results season provides a good opportunity to take stock of the broader earnings and more importantly OpFCF yield basis on which equities are priced. Relative to expectations at the start of the year, there have been […]

Continue readingAnother non-farm payroll and another missed opportunity to normalise rates

“Silence”. That is what I hear after yesterday’s March US non-farm payroll figures. Even a few months ago, these data points, while flawed were eagerly awaited as harbingers of revisions in US Fed monetary policy. Not any more. After February’s decision to hold rates in what looks like a clumsy attempt to goose oil prices […]

Continue readingYellen chickens out – again!

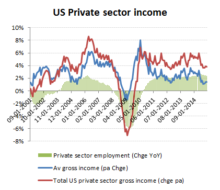

So much for the Yellen’s promise to be “data dependent” in its interest rate policy! With core inflation above the Fed’s forecast range, unemployment well within its longer term target range and private sector job and average wage growth offering no rational support for maintaining the near zero interest rate environment, Yellen’s decision to hold […]

Continue readingUS dollar rise has further to go before the Fed will panic

After the equity market drubbing into the first week of 2016, attention was back on the Fed and whether an expected weak set of employment data for December might provide some political cover to forestall the next upward revision in interest rates possibly due in March. If the Fed holds rates however, it won’t be […]

Continue readingYellen – Who are you calling Chicken?

LoL – Yellen chickens out of hike interest rate as expected. Indeed, one FOMC member appears to be expecting negative rates. Just confirms that the Fed has no idea how to get the patient off the hopium. This party is going to have to carry on until we finally get a currency collapse. With […]

Continue readingExpect Yellen to chicken out again on rate rise for September

Will she or won’t she? It seems with Fed interest rate policy remaining the only game in town, strategists are stuck with trying to second guess Yellen’s next move at the forthcoming FOMC on 16-17 September. Of course we’ve been here before and we can look at all the evidence and data under the sun […]

Continue reading