Wazzup? – 25th April 2017

- PPG (ppg) – Third time lucky for Akzo? PPG returns with further concessions and an increased offer worth €96.75 per Akzo ord

- Nielsen (nlsn) – Q1 FY17 results: US retail measurement continues to drag down the averages.

- Whitbread (wtb_l) – FY17 results: A cautious outlook statement blights a solid historic trading performance

- PPG (ppg) – Third time lucky for Akzo? PPG returns with further concessions and an increased offer worth €96.75 per Akzo ord

It’s always fun to watch a culture clash at work. Anglo-Saxon markets believe the shareholder interests are paramount, while on the continent they are just one of many stakeholders whose interests need to be considered. Hedgies who have loaded up on Akzo Nobel stock are going nuts, having seen two respectable offers from PPG get dismissed. With its third, and allegedly last attempt to engage Akzo management in a meaningful dialogue, PPG has upped its offer to €96.75 per Akzo share (including €61.50 ps in cash and 0.357 new PPG per Akzo), which is not bad given the previous offers were pitched firstly at around €80 ps and then more recently at 90 ps. If nothing else, it’s a testament to Akzo’s negotiating technique of not negotiating!

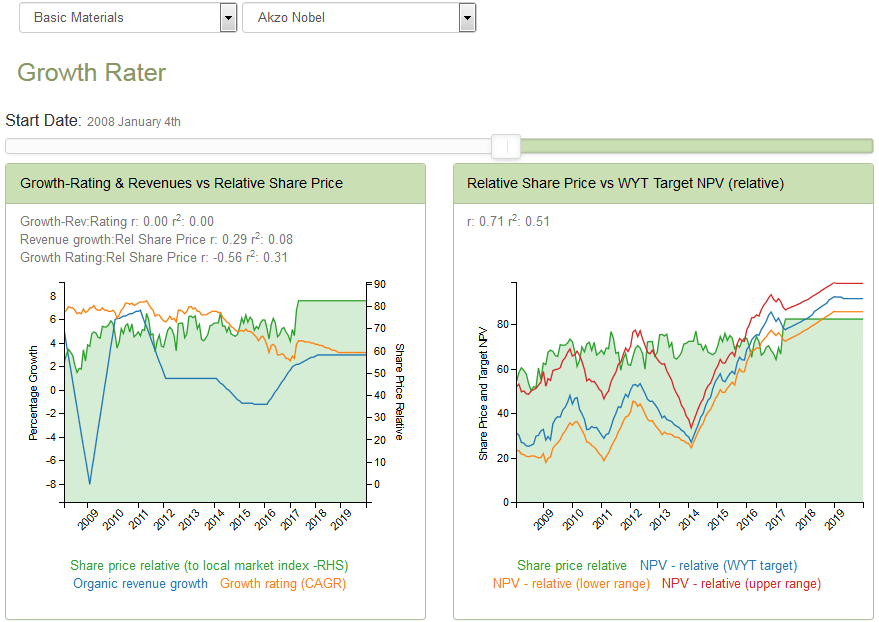

This time however, the Akzo management may have to to start a dialogue as the offer will be hard for them to beat in terms of what they can deliver as a stand alone entity, given the continued pressure on growth. In my own valuation I am applying a GrowthRating range on the stock of +3.5-4.5%, which compares with an historic 10 year organic revenue growth average of less than +2% pa and is also higher than current consensus revenue growth forecasts all the way out to FY19. If that wasn’t enough my valuation also includes the NPV of a half share of the $750m pa of PPG’s projected synergy benefits, grossed up at the market cost of capital and assuming a 25% tax rate.

2. Nielsen (nlsn) – Q1 FY17 results: US retail measurement continues to drag down the averages.

Another successful pump and dump by private equity, but probably a few burnt fingers for those that bought their stake and into the growth story a little over a year ago. At that stage, the shares were delivering not much more that +4% organic revenue growth yet were trading on a GrowthRating of over +6% CAGR, which considering the debt/EBITDA ratio approaching seemed at the time to be rather heroic. Fast forward a year and a squeeze on US retail measurement and some culling of some weaker custom research activities has dropped this organic revenue growth back to only a little more that +1% and the GrowthRating back to only +3% CAGR. Without the crutch of an adjusted PE ratio anymore, the shares are friendless, which is just how I like them.

Last trading update – Q1 FY17: Highlights included another new product led growth at its audience measurement division (Watch), but offset by another reversal in its retail measurement (BUY) segment revenues in the US, which pulled the division’s organic revenues to a -3.4% decline and the overall group to a rise of only around +1%. For FY17, the “flat” margin guidance is reiterated as is the organic growth of +3-4% on its newly defined and faster growth ‘core’ operations in FY17 (and therefore slower overall) suggests these trends are expected to persist.

More at: https://app.growthrater.com/