Correlation <> causation, but sometimes maybe!

When I was but a nipper, a wise old Chairman of a large and successful financial information business gave me a valuable piece of advice: That mediators extract better margins in poor information environments and when price discovery is obscured. As his business, amongst others, picked off and commoditised market after market with real-time pricing, newsflow and data, spreads narrowed and the mediators were increasingly forced in the opaque areas of finance where clients could still be bamboozled into chasing a higher return without appreciating the often killer tail end risk. While plain vanilla equity broking was being crushed, derivative margins soared as any old sows ears were packaged together and sold as silk purses, with a whole industry supporting the illusion. The key of course, as the Chairman knew, was the ability to withhold the relevant data from those on the other side of the trade; yes, the muppets. Raw data however without insight is not a solution. The ‘casino’ owners are not dumb and know how to bury the truth under a ton of information; hidden in plain sight. To better democtratize the investment process therefore needs insight and context to be applied to the content.

At WYT, our aim is to provide insight to what drives valuations and includes a search for systematic relationships, both internal (relating a company’s ability to grow with its ‘growth rating’) and external.

A feature we have recently added to our ‘growth rater’ analysis suite includes an auto-correlator which searches for the best correlation fit for a wide range of external macro factors against 5 company related factors to test for relationships in the way the shares perform (actual and relative), the possible impact to trading (organic revenues and margins) and the possible effects on valuation (via growth rating). Yes, we appreciate that correlation does not necessarily imply causation, but without such a perspective an investor is truly blind.

Often a correlation analysis confirms an obvious relationship, sometimes it reveals an absence of one that was expected and very occasionally offers that much desired WTF experience.

The obvious ones:

Yes, Royal Dutch Shell’s share price is tightly correlated to oil/energy prices

The interesting with hind-sight

Perhaps its more a reflection of a broader economic sensitively, but for an oil major to make better margins when there are more vehicles about is not totally without merit!

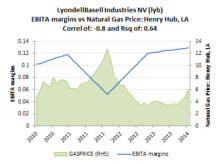

The yes, of course, but only if you already know that gas is the largest cost component for a chemicals group such as LyondellBassell.

Yes, its margins are negatively correlated with the gas price.

Another obvious one? A consumer staple with a share price that correlates with real personal income.

More income = more spending = higher share price?

Another consumer major with a high share price to consumption correlation

Wow, this investing business is getting easier!

Err, hang-on. A cyclical sensitivity to consumption ought not to imply a structural re-rating to a higher growth rating into the cyclical up-swing.

Perhaps, PepsiCo is just doing better in exploiting new and higher growth areas?

Er, nope. Actually this company’s organic revenue growth is negatively correlated to actual real retail & food sales.

So what have we got here? A share price that follows personal income, but this is not reflected in its sales and trading and therefore as a consequence its valuation (as measured by the growth rate that the shares are discounting – the ‘growth rating’) has to rise. Indeed, rise to well above its ability to grow its revenues.

My conclusion? Markets are clearly being inefficient and possibly lazy by using PepsiCo as a proxy for broader consumption. The principal culprit of poor pricing in current markets however is not too difficult to find – financial repression. In these dull days of command economics and crushed yields, a big mature business that can borrow cheap and payout big (85-90% of net income into share buy-backs and dividends over the last 5 years) is going to appeal to the muppets these days. Will it last? No, of course it won’t and if you think you’ll be the smart one to get out before the rush, then that’s what they all think!