Pearson AGM & Q1 IMS: a -4% decline in underlying revenues described as “solid”!

Pearson AGM & Q1 IMS

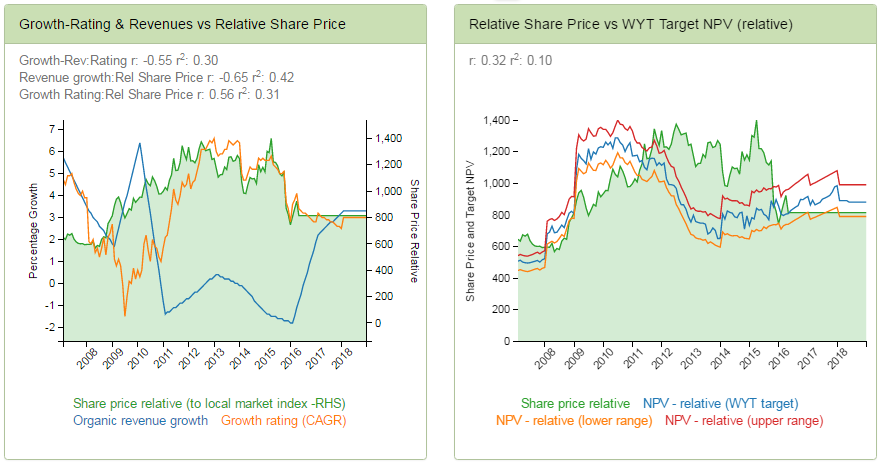

Nothing much to see here beyond a re-iteration of the forecasts/guidance made on the 29 Feb and a reminder, if needed, that group earnings are H2 weighted. I enjoyed however, the nice spin of describing Q1 trading as “solid” when organic revenues were down by -4% YoY.

I got in OK when the shares dumped a day before the FY15 results (around 655p ps – see blog post made at the time), but cut and ran at over 800p about a month later (again see that blog post also) and missed the final blow-off in the share price which hit approx 900p! With the shares back down to my NPV valuation again, I still think this one will be a long burn and with H1 trading never particularly relevant on the full year trajectory, useful trading data won’t be much in evidence until the H1 results in around September.

Key points in todays IMS

- Guidance re-iterated: FY16 adj Op Pft in range of £580-620m with adj EPS expected at 50-58p ps.

- Q1 revenues -4% organic on continuing operations, including -9% at =fx and -6% ‘headline’. Weakness in H1 weighted UK & US assessment

- Approx half of 4k FTE’s targeted for the chop now have the happy news.

- Cost savings from the restructuring remain unchanged. Of £350m pa from 2017, £250m are still expected in FY16

Conclusion: Better fishing elsewhere

More at: https://app.growthrater.com/

Plan ‘B”: cutting costs to solve a revenue growth problem. When’s plan ‘C’?