- Home /

- US jobs data

Good news now good news?

So is Good news now good for asset prices? For the last decade and particularly the last year however, its been more a case of multiple expansion driven by central bank/Govt money printing rather than rising returns that have been responsible for this asset inflation, so why would another month of robust growth in US […]

Continue readingUS porridge cooling, but still far from congealed

Another month of easing net job additions, but this time without the support of higher wage growth. Normally, such a report would be positive for markets, in that while not signalling recession, it is limp enough to keep the Fed dovish. As we approach 2020 however, the narrative around these monthly reports will become increasingly […]

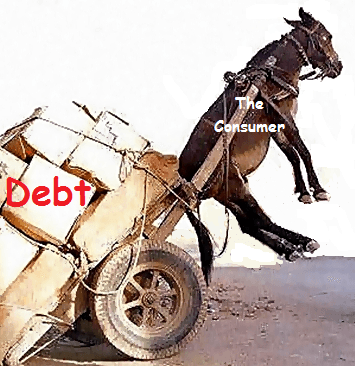

Continue readingWeaning consumers off the debt fix – maybe

Well that seemed short-lived. Perhaps the bounce in US equity markets on the February non-farms was just a one day wonder. The numbers however, weren’t too shabby for equity prices; the combination of a better than expected net job growth (including upward revision in the January guesstimate), but with a lower pace of average wage […]

Continue readingAuto & jobs slowdown in August – another excuse for the Fed not to raise rates!

Another month of hints about imminent interest rate increases by Yellen and the Fed leak machine and we are probably no closer to an actual rate increase. At least in July we had another relatively firm private sector job creation and US auto sales to suggest that the super-low rate environment was well past its […]

Continue reading