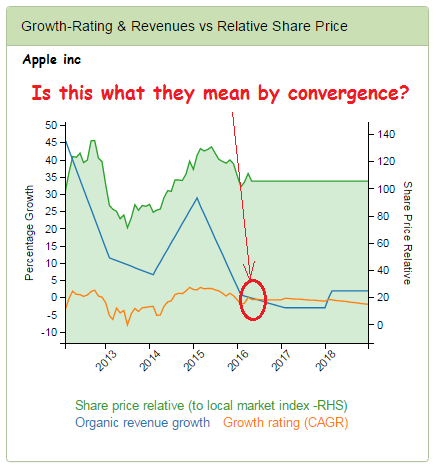

Apple Inc: What’s the next big thing for Apple should the stalling growth in iPhone sales mark the peak in this product’s life cycle? Improvements to the Mac may be invigorating that product line, but its contribution remains relatively modest to the overall group, while the weak health of the global laptop market does not suggest this will be it. iPad sales continue to erode, so is it to be the Apple Watch or some of the expensively acquired peripheral brands such as ‘Beats’ that are going to revive the growth expectations? With Q2 guidance suggesting a constant fx revenue decline of perhaps -5% with a -400bps contraction in operating margins, the parallels with Sony after the Walkman and Akoi Morita are becoming increasingly relevant. In our own valuation matrix we have tried to reflect this in a forward growth rating target range of only +0-1.5% pa, albeit we might also be suffering from a dose of recency bias here as is not inconceivable that if the Apple Watch is an expensive turkey and the now well publicised iPhone production cutbacks herald a deeper than anticipated sales drop-off, then we may be facing a period of falling revenues, with all the implications to the prospective growth rating that would come with such an event.

Last Trading – Q1 FY16: Revenues +1.7%/+$1.3bn to $75.87bn (vs guidance of $75.5-77.5bn), GM +20bps to 40.1% (vs guidance of 39-40%), Operating income -0.3% to $24.17bn (vs approx. $23.9bn implied from guidance), tax at 25.3% (-90bps YoY and vs guidance of 26.2%), net income +2% to $18.36bn (vs approx. $17.9bn implied from guidance) and EPS +7.1% to $3.28 (vs guidance implied of approx. $3.15) on a -4.9% reduction in average shares. DPS meanwhile was increased by +10.6% to $0.52 with period end net cash (incl securities) of $153bn (vs end Q4 of $150bn and after $9.8bn of shareholder cash returns in the quarter). YoY Revenues (at =fx) include Americas -1%, Europe +18%, China +17%, Japan -4%, and other Asia +19%. By product, this included iPhone at +1% to $51.6bn (+0% units), iPad at -21% to $7.1bn (-25% units), Mac at -3% to $6.7bn (-4% units), Services at +26% to $6.1bn and ‘Other Products’ at +61% to $4.4bn. QoQ revenues include Americas +35%, Europe +70%, China +47%, Japan +22%, and other Asia +101%. By product, this included iPhone at +60% (+56% units), iPad at +66% (+63% units), Mac at -2% (-7% units), Services at +19% and ‘Other Products’ at +43%.

Co Guidance for Q2 FY16: Revenues of $50-53bn (-11% YoY vs $58.0bn), gross margin of 39-39.5% (vs 40.8%), Op Exp of $6.0-6.1bn (+12.5% vs $5.4bn), therefore implying EBIT of approx. $14.2bn = -22.5% vs $18.3bn), other income of $325m (vs $286m) and tax at 25.5% (vs 26.9%). This suggests an anticipated net income of approx. $10.8bn (-21% vs $13.6bn) and EPS of around $1.95 (-16.4%) on the reduced average

shares in issue (of approx. -4.9%).