- Home /

- GrowthRater portfolio

Asset allocation for 2023 – first pick your macro scenario

Go into a car salesroom or estate agent (realtor) and ask if it’s a good time to buy and I think we all know what the answer would be. Why then should we be surprised at a similar response from those pushing ‘stawks’ and bonds for a living? Here, the year-end prognostications for 2023 from […]

Continue readingWPP’s armchair warriors

Markets love corporate activity. Bankers love them as shifting assets around companies earns them big fees. Managements love them because they provide opportunities to earn big bonuses. Investors therefore are encouraged to believe all this will enhance shareholder value, so as to endorse the merry-go-round. How many times have we seen acquisition led growth disguise […]

Continue readingWPP – once more unto the breach

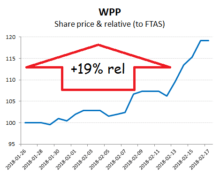

Having traded out of the stock with a +19% relative gain in the run up to their FY17 results, I didn’t expect to get an opportunity so soon to step back into this one, but with the shares approaching 1,200p (closed 1,204p), that is what I am doing. While there isn’t an immediate catalyst now […]

Continue readingWPP – position closed with a +19% relative gain (>+330% annualised ;-)

Add a bit of mean reversion to GrowthRatings, with a healthy pinch of recency bias and you can have a wild ride in these menopausal markets. For example, three weeks ago on this blog I highlighted the unloved Agency sector and in particular WPP. Those listening to what some key marketeers were saying about their […]

Continue readingWPP – friendless & unloved – perfect!

Not all marketing investment seems wasted. After P&G’s earlier withering criticism of its digital marketing ROI, Diageo’s Q2 report yesterday, delivering a combination of rising A&P investment, organic sales growth and underlying operating margins, suggests a more nuanced approach may be needed by investors to the industry’s current problems. Faced with an unsolicited approach from […]

Continue readingApple (aapl) – where to now?

It’s difficult to get overly excited with the shares. Having briefly rallied after the better than expected Q3 results, the long awaited new product launches do little to resolve the big question and the shares are back below their relative market level when I closed the GrowthRater long position back on 13 May, for a 29% […]

Continue readingClosing long position on Apple Inc (aapl) for a +29% gain (+105% annualised)

I am closing my long position on Apple (aapl) I established back in February at $121.4 ps. With the shares closing at $156.1 on Friday, that’s a gain of approx +29% over the 100 days held; an annualised return of 105%. GrowthRater porfolio – recent closed positions GrowthRater model portfolio additions – Apple […]

Continue reading