European Telecom sector – protracted investment cycle, or just a value trap?

Do telcos have pricing power; is the sector at the cusp of an upswing as it comes out of a protracted investment cycle, or just a value trap? For those despairing at the billions already being chucked at 5G licences (€6.5bn last week in Italy) before they’ve extracted much of a return from 4G, one ought to be wary. EU regulations and bureaucrats are not virtues I would normally extol, but it this case they’ve done an excellent job. Don’t take my word for it, just check out the vibrant levels of investment coming in to support the new services, but the declining marginal returns. For consumers that’s great, but for those investors hoping for a return to super-normal returns and above market income growth that’s going to suck.

The problem is not that Telco’s have lots of new toys for consumers to play with, but that these enhancements just get competed away. When you have at least three competitors (at scale) in a market running similar commercial models, technology and service propositions, then you should expect pricing in a heavily fixed cost business to gravitate to the lowest marginal return for the lowest cost operator on the most efficient capital structure. While there have been plenty of attempts to consolidate markets, which often gain local regulatory support, this has so far been thwarted by EU regulators, whose resolve will no doubt be hardened by the Italian 5G bid; suggesting that this policy is not adversely affecting future service investment.

To expand on this theme I have included 4 charts of aggregated data on my European Telco coverage, which includes, BT, Deutssche Telekom, Orange, Telecom Italia, Telefonica and Vodafone. With these, I hope to provide a clearer and more graphic representation of the changes afoot. This is no longer the traditional capital investment cycle which is followed by rising growth and ROIC, but a more fundamental compression in returns and growth for as long as EU regulators remain in control.

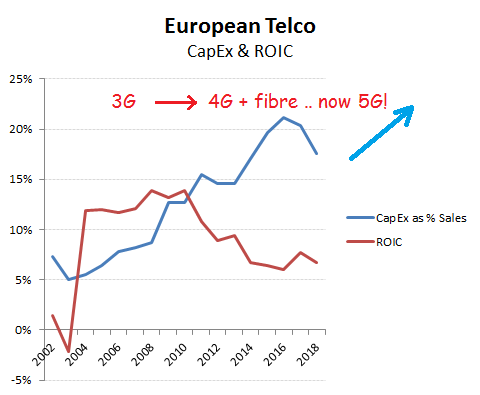

- 1) The Capital Investment cycle. Just when one might have been hoping that the rollout of fibre and 4G would see this drop back significantly to enable Telco’s to recoup previous investments as after previous cycles, the scale of last weeks 5G frequency bids in Italy (€6.5bn versus a minimum of €2.5bn) suggests otherwise. Despite its €25bn of debt, Telecom Italia was forced to cough up over €2.4bn as Vodafone scooped up 3 frequency blocks for a similar €2.4bn, with Iliad spending €1.19bn on some smaller bands. When you’re a hammer, I guess your stuck having to buy nails! In this, Telcos are in a similar boat to broadcasters with regards football rights. Each year the price goes up and each year they feel they have to bid, notwithstanding the declining marginal returns. It has become so extreme than for many rights (such as the World Cup), profits often actually dip during one of these events.

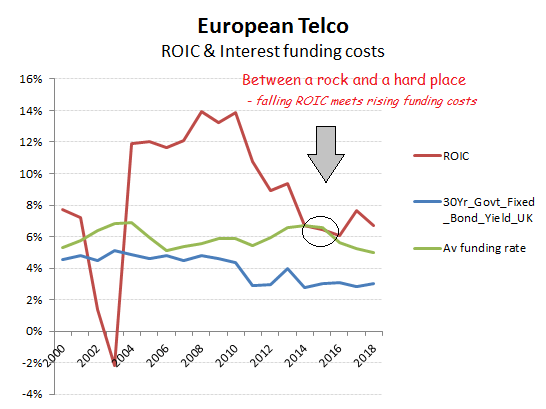

- 2) Rising Investment coincides with falling ROIC. Initially, this ought to be expected, but for this to be protracted and take ROIC to the marginal cost of funding debt is worrying, particularly into a hardening credit and interest cycle. While the ECB might maintain the fiction of its near ZIRP, the actual rates being paid by the industry are averaging nearer 4.5%.

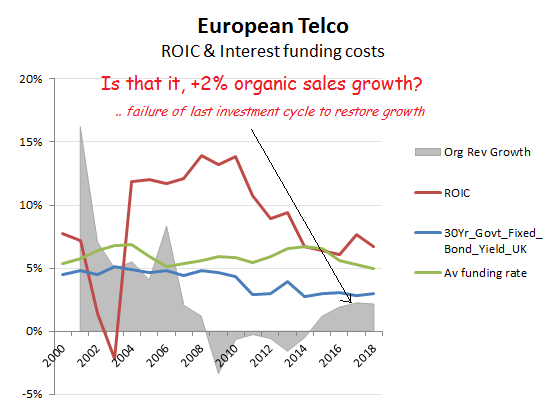

- 3) Failing Growth. At the end of an investment cycle, Telco’s would normally be reaping an accelerating revenue base from the introduction of new services. While the introduction of 3G and broadband was delivering organic revenue growth of upwards of +10% a decade ago for the sector, the best that can be said for now is nearer +2%; a paltry reward for bandwidth increases of 5-10x from fibre and 4G.

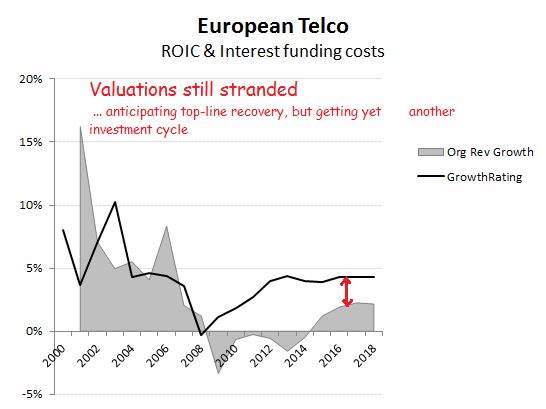

- 4) Investors slow to get the message. Perhaps its recency bias and the belief that the cyclical recovery in organic sales growth and ROIC is just a delayed phenomena this time, or that regional regulators will manage to recover control of the agenda to waive through consolidations of their favoured regional champions. Whatever the reason, the sector has been trading on an implied growth rate (my GrowthRating) of almost +5% CAGR since 2013. With even consensus forecasts assuming little recovery in medium term organic sales growth, this seems like wishful thinking. A similar feature has also been evident across swathes of the FMCG groups and I would urge you to check out the gradual de-rating of these groups (see the webApp). Miss the recovery for too long and ultimately markets get the message and price in what you’re delivering. Markets get you in the end!