Vodafone – Recovery play or just a value trap?

Are super-low interest rates good for capital intensive businesses such as the Telcos?

Intuitively, the answer seems obvious, in that lowering funding costs ought to improve the marginal returns from employing that capital. An analogy might be with fuel prices for airline stocks, with again a seemingly clear inverse relationship. In both cases however you might be mistaken. A couple of years ago I wrote a piece demonstrating that airline margins were actually positively correlated with oil prices rather than negatively, as one might have expected. Yes, that’s right, airline margins tended to go up when their principal cost also rose and not down. The reason as explained at the time is that fuel prices are a tide that raises or lowers all ships and that in a competitive market, these benefits are ultimately competed away. Move forward two years to the present and what have we got? Despite substantial tailwinds from fuel reductions still coming through, industry profit growth is stalling and in many instances moving into reverse despite continued volume growth in passenger demand as these fuel dividends are competed away in lower fares. In terms of specific stock selection, the drop in fuel prices might have been expected to provide the biggest proportional earnings boost to the lowest margin operators, thereby suggesting these stocks would garner the most benefit from lower fuel prices. Add in financial leverage and surely one should have been rotating into these bottom dwellers (usually to old European national carriers) – wrong! The below average margins were a reflection of their weaker competitive position which would be again cruelly exposed once the fuel dividend was competed away, with an added penalty of the apparent cost windfall encouraging their more unionised staff to push back on essential cost restructuring in the meantime. On a PEG ratio type of analysis, these bottom dwellers might have seemed like the attractive recovery plays, albeit a lack of appreciation of what really drives value growth in the sectors have caught them in a value trap instead.

If oil is the fuel used by airlines, the comparable fuel for a capital intensive sector such as Telco’s will be the cost of that capital. As with fuel prices, lowering funding costs should improve marginal returns, which with opportunities to apply that capital into increasing demand from the improved consumer proposition seems like a win, win proposition. For a sector now passing its investment peak and with new capacity now being released for marketing to service the exponential growth in data consumption, the industry must seem to be standing at the threshold of a recovery in margins and cash flows. As with airlines and aviation fuel however, cheap capital is only relevant if it provides a competitive edge, which given the scale and funding capacity of the major participants does not seem to be the case. Indeed, the consequences of central bank financial repression and floods of cheap capital may actually be the opposite. Funding costs may be reduced, but so are the return thresholds, while new competitors are encouraged to move up the risk curve for diminishing returns. For a capital driven sector, that is hardly a positive development and indeed, Vodafone’s recent €6bn impairment of its Indian assets following the emergence on aggressive pricing competition is symptomatic of this process. You might invest in improving your service proposition, which is reflected in increased demand, but if this is commoditised by comparative investment by competitors, then you won’t necessarily have the pricing power to recoup this downstream. If prices are set by the marginal returns needed to cover the cost of capital, then in a competitive market where the product offerings are essentially commoditised, then too much liquidity at too low a cost is merely going to ensure that pricing will always drop to the lowest rate of marginal return deemed acceptable, which in the world of financial repression, may be lower than investors expect.

For European Telco’s then, the question is whether the prospective recovery in margins and cash flows currently being discounted by valuations are just another value trap. The narrative to date seems to be either the improved service propositions will support premium pricing or that regulators will relent to permit some form of consolidation, although the series of abortive mergers and regulatory push-back over last couple of years suggests the opposite. If so, then assumptions of a firming pace of organic revenue delivery and margin expansion may prove optimistic, including perhaps my own assumptions!

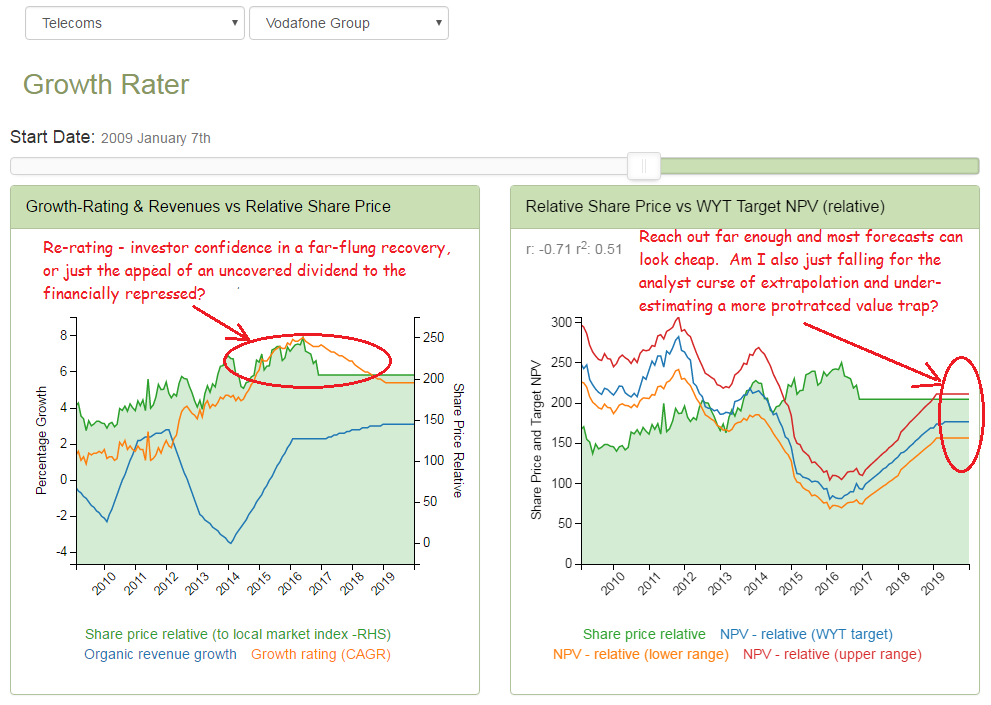

Vodafone GrowthRating and NPV analysis from the GrowthRater WebApp: https://app.growthrater.com/