‘Moar’ central planning call by new ECB chief

“Moar, Moar and Moar” seems to be the message from the ECB’s new president, Christine Lagarde in her first speech in that role. ‘Moar’ EU and EMU, ‘Moar’ fiscal loosening and therefore ‘Moar’ monetary indulgence that will be needed to pay for it. Perhaps more worrying however, was the central planning sub-text running through this short speech, reflecting the centrist leanings of this French politician turned faux banker.

Ms Lagarde has confirmed that monetary policy will remain loose as well as exhorting for ‘Moar’ government fiscal investment, which given the EU’s anaemic GDP growth and already high tax burdens, means yet ‘Moar’ QE and effective currency debasement down the road to pay for it, notwithstanding the ECB’s balance sheet assets are already over 40% of Euro19 GDP.

A couple of lines in her speech seems to recognise the role of the private sector with ” a stronger domestic economy also rests on higher business investment, and for that raising productivity is equally important”, but then proceeds to define her solution as being leveraging scale from being in the EU and Moar EU regulatory convergence, such as “the full implementation of the Services Directive”

If however, you were looking for a plan to encourage a more fluid application of private savings to invested into weaker Euro economies, then Ms Lagarde’s suggestion is straight out of the centrist playbook. Instead of stimulating investment by enabling higher returns from lower taxes and less regulation, it seems we need some more undefined “good institutions” to do this for us.

“The solution to the famous “paradox of thrift” is institutions. Good institutions exist to ensure that people are not forced into actions that are rational at the individual level but self-defeating collectively.”

Take some time to digest the above quote as it says a lot about the mindset of Ms Lagarde and her masters. To claim that institutions force rational investment decisions on individuals is absurd. In a free market system, individuals are free to decide on the relative merits of an investment for themselves and then reap the returns. What Ms Lagarde’s statement is really getting at is the last part, that these “rational” investment decisions by individuals are “self-defeating collectively“. Since Ms Largarde suggests that such institutions could therefore not be regarded as “good institutions”, what now, coerce them or exclude them from trading in the EU? For anyone in the EU supporting free market economics, this is is scary stuff indeed!

Such a speech however, would not be complete without trotting out some neo-keynesian clap-trap that ‘Moar’ public expenditure would pay for itself.

“This growth dividend would in turn help close the circle with public investment by ensuring that public debt is sustainable.”

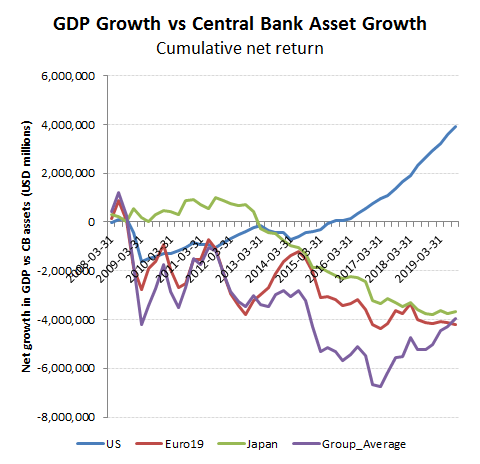

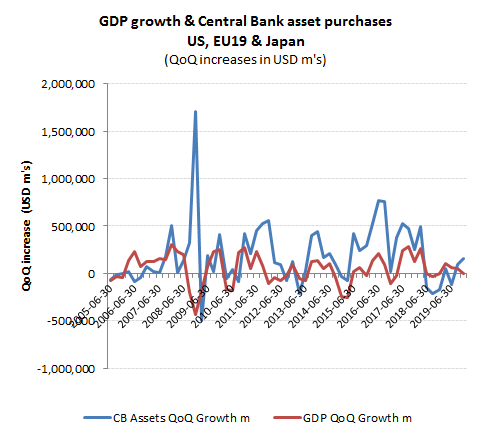

Unfortunately, the evidence suggests MMT and the QE programmes over the last decade across the US, ECB and Japan have not only not delivered a multiplier effect, but quite the reverse as we highlight in our section “The Marginal Buyer” in this site and as can been seen from the below charts. This chart the cumulative aggregated return of Central Bank Asset purchases vs GDP for the US, Euro19 and Japan , together with a chart plotting the QoQ movements for both. The only region to finally move back into the black has been the US, but only following its early decision to reverse QE, albeit this is now in jeopardy.

The evidence seems clear, that MMT and QE fails to yield a ‘Multiplier Effect on GDP, although this has yet to permeate through to the Central Banks who just think we need ‘Moar’. “Insanity”, as Einstein might conclude!