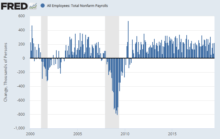

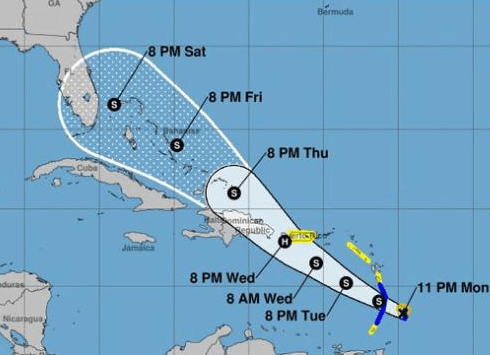

The cone of uncertainty

Yes, its ‘cone of uncertainty’ time again for hurricane watchers as Dorian ends up over 350 miles from where it was projected to be 5 days ago. Given that the 5 day margin of error on these forecasts appears to only around plus-or-minus 125 miles, this must temper President Trump’s relief that the current forecasts […]

Continue reading