Now you’ve been distracted, here’s the real US monthly job growth numbers

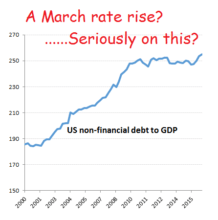

Gosh, with so much excitement going on in the world between the bombs, missile strikes and false flags it was easy to miss last week’s US non-farm payroll release for March. Not that one would have missed much. Having delivered its much anticipated second rate increase in the current tightening cycle, the Fed no longer […]

Continue reading