- Home /

- Author's Archive:

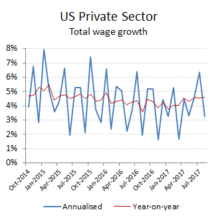

US wage growth slows in August

In between hurricanes, German elections, North Korean bomb and missile tests and the usual Jackson Hole navel gazing fest for central bankers, the August non-farm payroll estimates from the BLS may have struggled to make the front pages. At +165k, net private sector job additions for the month (+174k excluding movements in seasonal adjustments), it […]

Continue readingRising interest rates may be exposing advertising ineffectiveness

With the WPP share price down -11% on its Q2 earnings release, as FY17 revenue growth forecasts are trimmed along with market estimates for global advertising growth, I thought about writing a long winded post about markets propensity to increasingly aim below guidance towards the end of an economic cycle and in particular while the […]

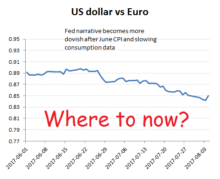

Continue readingUS adds +205k jobs in July – normally a positive for the US dollar, but now?

The problem of communicating a softening macro outlook is that it lowers interest rate expectations which in turn is a buy signal for not just investors, but also recruiters. So while the IMF cut its US GDP expectations for 2017 and 2018 by -20bps and -30bps respectively (both now to +2.1%) and currency markets have ‘drumfped’ […]

Continue readingP&G slashes digital spend with no impact – an ‘Oops’ moment for digital!

Those following Alphabet’s Q2 results may have noticed the changing mix driving revenues. While year-on-year organic revenue growth is still comfortably holding above +20% pa, it is increasingly driven by accelerating growth in paid clicks which are offsetting a higher rate of decline in the price per click that it receives. Given the auction basis […]

Continue readingWazzup – 27 July 2017 – a results palooza!

A results deluge today as companies report Q2 numbers ahead of the August holidays. Updates from RELX, ITV, DMGT, Sky, A3M, S&P Global, Amazon, Comcast, Nielsen, Solocal, Barrick, Dow Chemical, Fiat Chrysler, Eastman Chemical, BASF, Air Products, Danone and VW, to name a few. RELX – H1 FY17 results. Fortunately, another steady […]

Continue readingInterpublic Q2 disappoints – the canary in the coal mine?

From the -100bps drop in margins as organic sales growth slowed to only +0.4% for its Q2, IPG clearly didn’t see it coming, particularly following the solid performance in Q1 and the easier prior year comparatives it was cycling against for Q2. This lack of visibility and the uncertain impact of Fed monetary tightening on […]

Continue readingYellen does virtuous – 5 years too late!

Confused? Well you should be be if you’ve been believing the usual output from the Federal Reserve. Contrary to the narrative of robust US economic growth and tightening labour markets requiring a normalisation of interest rates, things aren’t quite as rosy as Ms Yellen had been suggesting. Behind the increasingly absurd non-farm payroll data with […]

Continue readingWazzup – 11th July 2017

German specialist cooker manufacturer Rational took top honours today with its guidance upgrade as US chain sales continue to storm ahead while back in Brexitland, an underwhelming Q1 sales report from M&S and for Pearson a difficult attempted exit from its consumer book venture (PRH) did little to lift the gloom. . Rational – FY17 […]

Continue reading