- Home /

- Miners

Soaring gold prices and gold miners

As markets lose faith in the Fed’s ability to manage its easing pivot, gold and silver prices are soaring to new records notwithstanding hardening long bond yields. For investors wanting to participate in this trade, the choice seems to be between physical gold bullion, paper gold certificates or those mining the stuff. Those with a […]

Continue readingA Reserves based Valuation for Gold Miners

Resources companies can often present a quandary for traditional valuation techniques. Is a hole in the ground a potential asset, or the guys digging it worth an opportunity premium in case they find more gold? They are of course a bit of both, but the long lead times from sinking the capital to delivering the […]

Continue readingAll that Glitters

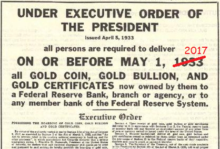

In December 2009 as the gold price was inexorably rising in the face of central bank currency debasement, called QE, we started to get scare stories about fake gold. A decade later and the Fed is back to its old tricks again and investors are rushing into the yellow stuff to preserve capital and once […]

Continue readingGold returns

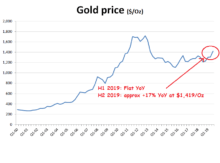

Was it the flip-flopping Federal reserve or Draghi’s increasingly desperate attempts to reflate the ECB debt balloon, but with Iran scare stories it has done wonders for the gold price. While forthcoming Q2 results will be pretty drab for the industry, with H1 average prices broadly flat YoY, the second half is on track for […]

Continue readingGolden opportunity or just Cultural appropriation?

For Gold bugs, wouldn’t you rather invest in a miner, where its production currency had contracted by almost -20% relative to gold’s principal selling currency, the US dollar? Unfortunately, when the currency in question is falling due to political instability and government threats of confiscation without compensation of property based on race, then the answer […]

Continue readingPOTUS missile attack on Syria – more Kabuki theatre than prelude to WW3

Markets attempt to discount the future, which for the present often means trying to anticipate what the new POTUS is up to. Unfortunately, when he is failing to deliver what he promised (Healthcare and tax reform), but doing what he explicitly said he wouldn’t (bombing Syria) one might be forgiven for wanting to move into […]

Continue readingGold & Gold miners – when to buy and how to value

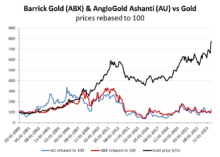

The gold price might be troublesome to predict, but at least the relationship between this and the share price of gold miners such as Barrick are proving to be more reliable. Back in July when I initiated coverage, I suggested markets were applying what seemed to be a ridiculously simple valuation methodology. Forget IRR with […]

Continue readingDo central banks see a problem with Barrick?

There is something rather ironic about Central Banks using deflation as an excuse to print cash which is then used to buy gold shares, which are of course a leveraged play on rising gold prices which in turn are a reflection of the lack of confidence in central bank monetary policies. For the Swiss CB […]

Continue reading