- Home /

- Politics

October US payrolls – a recession for many

Once again we have a US government department (Bureau of Labor Statistics – BLS) conveniently releasing some economic guesstimates that are supportive of the official narrative and the Fed’s decision to again hold interest rates unchanged. According to this, inflationary pressures from the jobs market are abating as wage growth tumbles to a sub-inflationary +2.5%, […]

Continue readingUnited States can “certainly” afford to support wars on two fronts – Yellen

A runaway deficit already at around $2tn pa and rising interest rates as the US government is forced to compete for funds to pay for this and US Treasury Secretary Janet Yellen wants us to believe her administration can afford another war. For those bond funds already burned from believing her claims in 2021 that […]

Continue readingMore misdirection from US jobs data

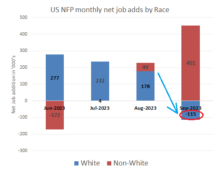

Once again it is amusing to see the monthly US non-farm payroll statistics get used to provide cover for the usual misdirection by the US Fed/Govt. The approved message markets are meant to take from the BIS guesstimate of an improving trend in private sector net job additions in September (of almost +260k MoM), is […]

Continue readingRising US federal debt and maturites pose uncomfortable truths for ‘no/soft’ landing assumptions

As of the 1st September, US Federal debt was estimated to be nudging $32.6 trillion, having been increasing by approx +$1.4 trillion per quarter following the abandonment of the debt ceiling and the last vestiges of Congressional constraint. Annually, that represents almost $7tn of new debt, which together with a further $7.5tn of existing debt […]

Continue readingJune US employment running warm, rather than hot – albeit a bit of a red herring for US Fed rates

If yesterday’s 10 year yield bounce to over 4% was a function of a more aggressive further interest rate rise by the Fed this month after the June ADP figures, then today’s cooler employment estimates for June from the BIS in its non-farm payroll figures may help dampen some of those fears. All this however, […]

Continue readingEquity’s siren call into early stagflation

Has the US Federal Reserve lost control of the narrative? Much as it has tried to sound hawkish, its actual actions into the first half of this year have instead communicated a lack of real resolve, which along with the political retreat on fiscal control with the abandonment of the ‘debt ceiling’, has left equity […]

Continue readingTreasury yields after debt ceiling ‘can-kicking’

Kabuki theatre remains alive and well in DC, and yet again, after all the histrionics from both sides of the aisle, the government will just keep spending money it doesn’t earn. While details have yet to be released, it seems the best result that Speaker McCarthy could secure was a budget cut of a measly […]

Continue reading1 month T-Bill yield spreads expand by >160 bps in April – Signs of growing stress!

Whether it’s a flight to safety, a rush for USD collateral, or perhaps something else, the sudden divergence of the 1 month US T-Bill yields against the rising trend across all the longer maturities over the first three weeks of April doesn’t appear to bode well for markets. For the USD however, this may reflect […]

Continue reading