- Home /

- bond yields

Rising Bond Yields & a Flattening Curve

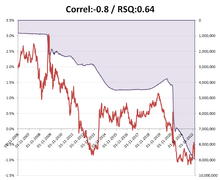

A flattening yield curve is often seen as an ominous portend of economic doom, while a forced increase in interest rates can often ensure its delivery. This convergence however, is the conclusion of a tale that has been in the making for a couple of decades, but one where the inflationary consequences now threaten to […]

Continue readingHobson’s Choice – Rising rates or a currency crisis

Just how much red pilling can a market take? How about the realisation that the economic recovery following the 2008 financial crash as been an illusion based on monetary easing that was conducted in a way to disguise the inflationary consequences, overstate economic growth while forcing investors up the risk curve, where they will be […]

Continue readingUS debt ceiling and the point of no return

What is the drifting gold price trying to tell us, because rising inflation and reckless government fiscal policies suggests impending currency debasement? Is this just another case of cognitive dissonance, that has accompanied COVID-19(84), or perhaps a temporary phenomena such as a big holder being forced to sell gold to raise USD to cover some […]

Continue readingMarket algos chasing Central Bank intervention, rather than anticipating it

Markets are going with the ‘flow’, because that’s the only way to trade these algo-driven markets. The new Fed chairman flip-flops from hawk to dove while the ECB hint at following suit (ahead of its May parliamentary elections) and the Chinese unleash another Tsumani of credit. Equity valuations meanwhile recoup the Q4 lost ground, notwithstanding […]

Continue readingWhat equity valuations might be trying to tell you!

Hang on, according to the ‘experts’, this wasn’t supposed to happen! Having been fed a diet of gloom by everyone from Hedgies (Bridgewater), Academics/Economists (Dartmouth/MITI/Krugman), Banks (Citi) and wealthy investors (Mark Cuban – see end for links) should Trump get elected, markets have done what they do best and confound the experts, with US equity […]

Continue readingMarket crash? – depends who blinks first

Although the GrowthRater is a relative engine to establish stock valuation and risk relative to to broader market equity returns, that doesn’t mean we aren’t keenly aware of what these are, or might become, it is just that we do not impose our view on whether this is good or bad on the investment process. […]

Continue reading