- Home /

- Economics

US jobs growth – not ‘Yuge’, but good enough

Net private sector job adds in October of +131k, with average wages stabilising to +2.6% annualised and +3.0% YoY is about as close to a ‘Goldilocks’ scenario’ as one could reasonably expect in the current trade war. While perhaps disappointing for those hoping for further Fed easing, the October jobs data is not without its […]

Continue readingUS porridge cooling, but still far from congealed

Another month of easing net job additions, but this time without the support of higher wage growth. Normally, such a report would be positive for markets, in that while not signalling recession, it is limp enough to keep the Fed dovish. As we approach 2020 however, the narrative around these monthly reports will become increasingly […]

Continue readingUS August jobs – porridge tepid and cooling

Markets weren’t expecting much from the August non-farm employment data and they didn’t disappoint. While average wage growth remained solidly above +3%, the underlying rate of private sector job growth slipped back to an anaemic +64k, with +15k of this coming from temporary help. Although comfortably ahead of the level of contraction that would signal […]

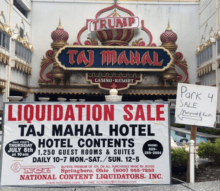

Continue readingWinning a trade war?

Good to see US & China agreeing to meet next month and hopefully they’ll start to settle their trade differences. Clearly Trump’s buckling, as China shows itself to be made of sterner stuff than to worry about lower pork imports from the US, despite half their own herd being wiped out by pig ebola. Kenyan […]

Continue readingUS GDP growth too strong in Q2?

Having bumped up the reported Q1 GDP growth numbers, the US administration now seems content to push a (modestly) slower growth narrative in order to support the current dovish Fed. As with the non-farm payroll seasonal adjustments, the GDP numbers are becoming increasingly unreliable as a true indicator of current economic growth and more a […]

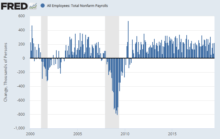

Continue readingWeak job growth? Just fiddle the seasonal adjustments!

How can the Fed contemplate cutting rates when US Q1 GDP growth allegedly came in at over +3% and June saw a +224k MoM rise in employment? Perhaps because it knows these headline numbers are garbage and that the true underlying numbers are considerably worse than these. Having already commented on the fiddles used to […]

Continue readingLies, damn lies and Govt statistics

On Friday 25th the US will report its advance estimate for Q2 GDP growth, although the main point of interest may again be the how the numbers have been doctored to fit a political narrative. Back on 5 May, we highlighted the way in which the Q1 growth estimate of +3.2% had been overstated and […]

Continue readingUS job growth stalls – a more reliable indicator than initial GDP

Well, well, once again the monthly non-farm payroll numbers provide the insight on the real state of the US economy. As with 2008, forget the official GDP numbers, or at least the initial ones. Forget also the the spin from those with an interest to persuade you everything is dandy, particularly those encouraging you to […]

Continue reading