- Home /

- Valuation

Pearson – resorting to one-off non-cash tax items to try and spice up a tired recovery story

Pearson was for a while the darling of the sector, with a recovering top line supported by substantial cost reductions and an fx tailwind from the appreciation in its principal trading currency, the US dollar. Beyond this however, there was only limited evidence that the ship is being turned about, in terms of what really […]

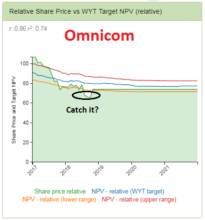

Continue readingOmnicom – yes it was oversold after Q2!

After seeing its shares tumble 10% immediately following its Q2 results, I added a position in Omnicom across a couple of portfolios I manage. It wasn’t that I was won over to the structural growth story for these marketing services agencies, but more a function of two things. Firstly, there is a price for everything […]

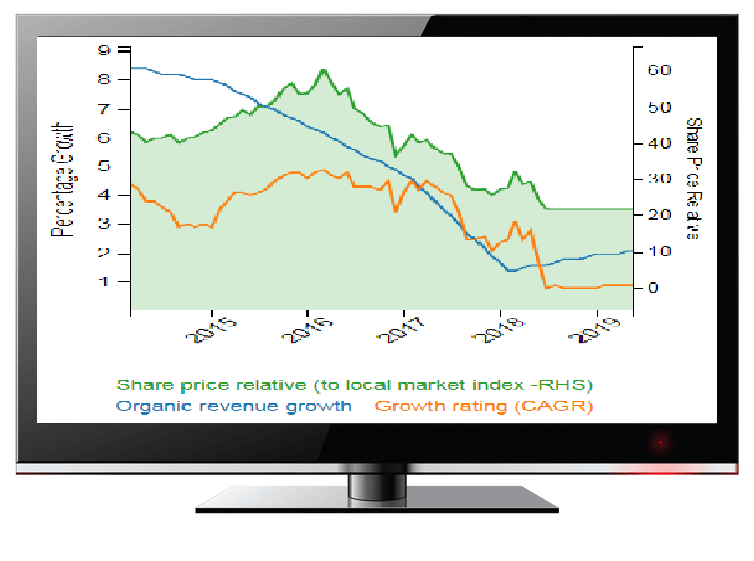

Continue readingPPG – rising costs exposes weak pricing power. An increasingly common story

Tax reductions, tariff walls and a trillion dollar plus increase in Federal debt to fund the party and one might have thought that bond markets would be fretting about inflation. Perhaps surprisingly and despite the absence of Fed price distortions as a buyer of its own junk, the inflation rate implied from the TIPS-fixed Treasury […]

Continue readingAre equities expensive?

The spike in US bond yields has implications for equities, but perhaps not as directly as one might imagine. Yes, long bond yields and particularly TIPS, provide an effective proxy for a risk-free return and therefore the essential anchor for valuing other asset classes, but only from a relative rather than absolute perspective. It may […]

Continue readingEuropean Telecom sector – protracted investment cycle, or just a value trap?

Do telcos have pricing power; is the sector at the cusp of an upswing as it comes out of a protracted investment cycle, or just a value trap? For those despairing at the billions already being chucked at 5G licences (€6.5bn last week in Italy) before they’ve extracted much of a return from 4G, one […]

Continue readingDo they know something? Informative conformity and stocks

The herding instinct is strong in markets. Solomon Asch would characterise this as ‘informative conformity’ where the participant would disbelieve the evidence of their own eyes and yield to the group think. In Asch’s experiments, the results were remarkable, particularly given the exclusion of outside variables beyond the comparative data (the height of the columns […]

Continue readingProsieben – a sub +1% growth stock or just oversold?

Spare a thought for those long suffering shareholders of German commercial TV stocks, RTL and Prosieben as Morgan Stanley dumped on the stocks with a negative report on Friday, sending them down a further 7% and -6% respectively against the DAX index that was up +1%. Presumably it was another rendition of the argument that […]

Continue readingAre you applying the wrong valuation currency?

Prices are set by the marginal buyer, while financial markets establish conformity around valuation currencies that encourage buying, which in turn stimulates more borrowing and therefore more ‘moolah’ for those that dominate these markets. The latter obscures the ‘real’ price that is being paid by the former, which is why they need tools such as […]

Continue reading