- Home /

- Valuation

A Reserves based Valuation for Gold Miners

Resources companies can often present a quandary for traditional valuation techniques. Is a hole in the ground a potential asset, or the guys digging it worth an opportunity premium in case they find more gold? They are of course a bit of both, but the long lead times from sinking the capital to delivering the […]

Continue readingLab-leak hypothesis – and the next shoe to drop?

Investing can sometimes feel like quantum physics, where there is no reality, but just a probability of outcomes. While valuing a potentially miss-priced asset on an existing consensus perception of reality is one challenge, this is a mere entree to the broader problem that the future is unlikely to pan out as per the current […]

Continue readingChoices

“Everything is awesome” it seems for equities. An accommodating central bank, another goldilocks US jobs number, reducing trade tensions, de-escalating war drums in the Gulf and also reducing political risk as the US seems on track to follow the UK by keeping the fiscal crazies away from the government purse strings, when they go to […]

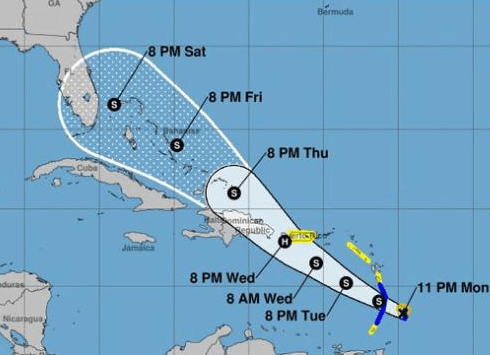

Continue readingThe cone of uncertainty

Yes, its ‘cone of uncertainty’ time again for hurricane watchers as Dorian ends up over 350 miles from where it was projected to be 5 days ago. Given that the 5 day margin of error on these forecasts appears to only around plus-or-minus 125 miles, this must temper President Trump’s relief that the current forecasts […]

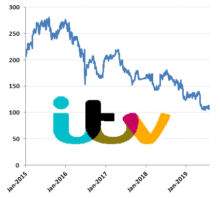

Continue readingITV – a mean reversion

When in doubt, it seems we all try and cling on to our normalcy bias. While ITV (itv_l) might seem an odd example of markets use of a ‘mean reversion’ to provide a valuation anchor point, this very much depends on the metric used and the perspective sought. Use a fixed metric such as a […]

Continue readingM&A mantra: When in a hole, keep digging!

M&A in the Marketing Services sector is a bit like archeology; if you find yourself in a hole, keep digging! This is how companies such as Publicis, can propose to invest a further $4bn on another digital marketing acquisition, notwithstanding presiding over an eroding organic top line and sub market ROIC, notwithstanding splashing out over […]

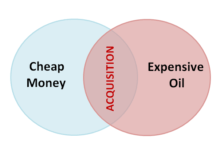

Continue readingChevron offer for Anadarko – when cheap money meets rising oil prices

A return to ‘cheap money’ by the Fed and stabilising oil prices and it is perhaps not surprising to see a return to acquisition led growth strategies. For Chevron, its $50bn agreed offer for Anadarko looks to be broadly OpFCF neutral after $1bn of projected OpEx cost synergies from combining these two predominantly North American […]

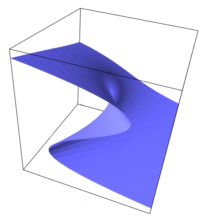

Continue readingThomas Cook Group – analysis, or time for catastrophe modelling?

The recent gyrations in the Thomas Cook share price (a +50% surge yesterday and -13% correction today), might have you reaching for your catastrophe models, but its volatility after its latest guidance cut ought not to be that surprising. Combine a volatile top line with low margins, substantial financial leverage and a low rate of […]

Continue reading