- Home /

- Ryanair

Airlines – what happens when ROIC looks too good

So much for IATA’s prediction last year of “Normal profits are becoming normal for airlines”, or the thesis that airlines would again be able to pass on higher fuel prices to customers by charging higher fares. Someone must have forgotten to tell Ryanair, as they cut a further 10 percentage points from their current year earnings […]

Continue readingPPG – rising costs exposes weak pricing power. An increasingly common story

Tax reductions, tariff walls and a trillion dollar plus increase in Federal debt to fund the party and one might have thought that bond markets would be fretting about inflation. Perhaps surprisingly and despite the absence of Fed price distortions as a buyer of its own junk, the inflation rate implied from the TIPS-fixed Treasury […]

Continue readingRyanair plays union hardball

Ryanair’s Michael O’Leary might sound pro-EU when it comes to Brexit, but his commercial approach is about as Anglo-Saxon as one can get. For the soon to be disenfranchised UK investors after Brexit, it must therefore come with a certain sense irony to see the group playing hardball with its Continental unions. While shareholders may […]

Continue readingFake news volcano scare – an opportunity!

Don’t let the truth get in the way of a good story. According to the Sunday Times yesterday (23rd September 2018), a volcano in Iceland (indeed an “Icelandic giant” called Katla no less) is “about to erupt”. “The ash plume that brought European air travel to a standstill in 2010 could be dwarfed by an […]

Continue reading“Normal profits are becoming normal for airlines” – be afraid!

Recency bias is alive and well. “At long last, normal profits are becoming normal for airlines”, so says the IATA in its June 2018 industry update titled “Solid Profits Despite Rising Costs”. After a couple of years of improving margins and ROIC, is this a paradigm shift for investors to jump aboard? Unfortunately, it feels […]

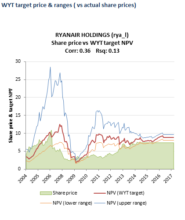

Continue readingRyanair – when the music stops

Many companies resemble sharks. Not just for their need to keep eating new prey to grow, but to keep growing to stay afloat. The capital intensive airlines are perhaps the most glaring example of this in action, particularly given the additional scale advantage that can be secured. The problem for investors however, is being able […]

Continue readingGrowthRater portfolio: Closing long position in IAG for +33% gain in 6 months (+24% relative to FT Allshare)

Having added IAG Plc (IAG_L) to the GrowthRater portfolio in those dark days post the Brexit vote I am now closing the position and taking my gains. With an entry price of 359p and exit price of 476p, that represents a gain of approx +33% over the six months. Over the same period the FT […]

Continue readingBudget airlines soar in September, but war of the handbags still being fought

Ryanair is still packing in the passengers (Sept +5% with load +5ppts to 90% vs +7.5%/+2.5ppts respectively for EasyJet), although with the Air France strike settled and the end of the summer holiday season I would expect the Oct traffic figures to be a little less supportive. The stock is still my preferred one in […]

Continue reading