- Home /

- Author's Archive:

eBay – Closing long position with gain of +30% (+28% relative: +60% annualised)

eBay long positioned closed at $31.9 ps to crystallise a >+30% absolute and +28% relative gain (vs the S&P500) since we added the stock to the GrowthRater portfolio, just over 5 months ago at $24.5 ps (http://growthrater.com/ebay-added-growthrater-model-portfolio-close-price-24-49/). Annualised, that represents a return of +65% on the trade and +60% on a relative basis against the […]

Continue readingSeptember US non-farm payrolls fall short of expectations – again

The headline seemed so authoritative (“U.S. nonfarm payroll job growth seen pushing case for Fed hikes”) and coming from Reuters as well! http://www.reuters.com/article/us-usa-economy-idUSKCN1270BP Unfortunately, notwithstanding coming off a weak August, September’s non-farm payroll additions of +156k (and +167k for the private sector) fell short of the +175k predicted from Reuters survey of economists. So does […]

Continue readingTesco investors O/D on the Recovery Effervescent Powder

Back in 2013, consensus forecasts were predicting operating margins for FY14 and FY15 in excess of 5% and which in less than a couple of years had more than halved to little more than 2.2%. It is perhaps not surprising therefore that after almost -£8bn of restructuring and impairment charges across FY14 & FY15 and […]

Continue readingBrexit sitzkrieg

Over three months on from the Brexit vote and the World still turns and UK economic activity has been largely unaffected, with August retail sales up +6.2% YoY and September data showing UK consumer confidence index returning to pre-referendum levels (GfK) and UK manufacturing PMI (Markit) hitting 55.4, the highest level since May 2014. Lower […]

Continue readingUS state tax receipts fall by -2.2%; hardly a prelude for a Fed rate increase!

Sometimes the ‘facts’ are difficult to reconcile, particularly when these are government statistics. For Yellen this has included maintaining the fiction that all is well with the US economic recovery, but not so good that the Fed should take its foot off the monetary accelerator. Along with other market commentators we monitor the monthly data […]

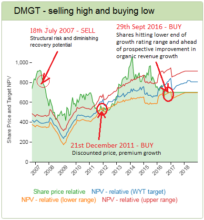

Continue readingDMGT – added to GrowthRater model portfolio at 704p

DMGT – added to GrowthRater model portfolio at 704p The shares have been off my radar over the last couple of years after having broken above the top of my GrowthRating range (of +2.6-4.1% CAGR) and as organic revenue momentum dropped below this as the structural decay in print advertising continued, falling oil prices impacted […]

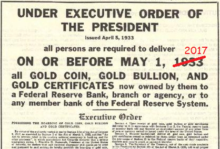

Continue readingDo central banks see a problem with Barrick?

There is something rather ironic about Central Banks using deflation as an excuse to print cash which is then used to buy gold shares, which are of course a leveraged play on rising gold prices which in turn are a reflection of the lack of confidence in central bank monetary policies. For the Swiss CB […]

Continue readingMarket crash? – depends who blinks first

Although the GrowthRater is a relative engine to establish stock valuation and risk relative to to broader market equity returns, that doesn’t mean we aren’t keenly aware of what these are, or might become, it is just that we do not impose our view on whether this is good or bad on the investment process. […]

Continue reading