- Home /

- GrowthRater

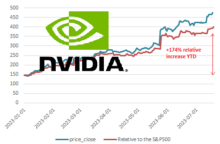

NVIDIA – an anatomy of a valuation

Since the start of the year, NVIDIA’s stock price has trebled, while the consensus EBITDA has ‘merely’ doubled, even reaching out to FY25. While inevitably reflecting a medium term multiple expansion to bridge that gap, the actual mechanism is not some sort of opaque PEG type ratio, but the systematic relationship between growth and the […]

Continue readingJune US employment running warm, rather than hot – albeit a bit of a red herring for US Fed rates

If yesterday’s 10 year yield bounce to over 4% was a function of a more aggressive further interest rate rise by the Fed this month after the June ADP figures, then today’s cooler employment estimates for June from the BIS in its non-farm payroll figures may help dampen some of those fears. All this however, […]

Continue readingEquity’s siren call into early stagflation

Has the US Federal Reserve lost control of the narrative? Much as it has tried to sound hawkish, its actual actions into the first half of this year have instead communicated a lack of real resolve, which along with the political retreat on fiscal control with the abandonment of the ‘debt ceiling’, has left equity […]

Continue readingTreasury yields after debt ceiling ‘can-kicking’

Kabuki theatre remains alive and well in DC, and yet again, after all the histrionics from both sides of the aisle, the government will just keep spending money it doesn’t earn. While details have yet to be released, it seems the best result that Speaker McCarthy could secure was a budget cut of a measly […]

Continue reading1 month T-Bill yield spreads expand by >160 bps in April – Signs of growing stress!

Whether it’s a flight to safety, a rush for USD collateral, or perhaps something else, the sudden divergence of the 1 month US T-Bill yields against the rising trend across all the longer maturities over the first three weeks of April doesn’t appear to bode well for markets. For the USD however, this may reflect […]

Continue readingMMT – Safe and Effective?

An experimental theory adopted by a financially rewarded ruling oligarchy has always been difficult to fight against, so you won’t find many among those beholden to them that will be prepared to risk their careers by challenging the status quo. Until it is too late, that is! We therefore have entered a twilight zone where […]

Continue readingSVB failure – Moral Hazzard? Yellen Says No Bail Out

Will the US government again be bounced into bailouts following last week’s shock failure of Silicon Valley Bank (SVB) and subsequent seizure by the FDIC? The seemingly emphatic answer from ex US Fed chair and now US Treasury Secretary Janet Yellen is not. “We’re not going to do that again,” she is reported to have […]

Continue readingNothing to see here, move along..!

Back in November, I reported on the alarming increases in excess mortality and as this blog’s prime focus is on financial markets I thought to express this reality through the share prices of two groups that were on opposing sides of this dynamic. This included Lincoln National (LNC) which insures the living and Service Corp […]

Continue reading