- Home /

- Oil

Pain at the pump? – blame the woke governments and not the oil majors!

In the UK, forecourt (pump) fuel prices are up +35% for both petrol and diesel (to 191p/199p respectively) from the last time the price of brent crude held above $120/bbl in Q1 2012. With the oil majors having all reported a strong increase in refining margins and downstream profitability, it must be tempting therefore suggest […]

Continue readingBe careful what you wish for!

“Is this deliberate?” is becoming a more familiar question as people slowly awaken. The answer of course remains an emphatic “Yes”, but it is the growing realisation of this agenda that is the important feature here. ‘They’ told you that money printing was good, that lockdowns work and are legal, as are mandating experimental gene […]

Continue readingTrump’s oil supply leverage

It says a lot for either the weak outlook for global GDP growth or the limited threat posed by the Iranians, that a series of attacks and seizures of oil tankers in the Straits of Hormuz, a conduit for around 20% of the world’s oil needs, as had no appreciable impact on crude oil prices. […]

Continue readingChevron offer for Anadarko – when cheap money meets rising oil prices

A return to ‘cheap money’ by the Fed and stabilising oil prices and it is perhaps not surprising to see a return to acquisition led growth strategies. For Chevron, its $50bn agreed offer for Anadarko looks to be broadly OpFCF neutral after $1bn of projected OpEx cost synergies from combining these two predominantly North American […]

Continue readingEngineering a ‘Santa Rally’ in oil, but what then?

If the price of continued US support after the Khashoggi murder was the lower oil price, then it must rank as one of the most expensive assassinations of journalist in history, with Saudi Arabia’s gross oil production revenues down almost $2bn per week. The attempt to resurrect his political reputation at the G20 meeting was […]

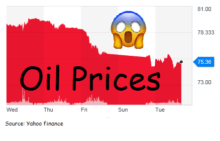

Continue readingOil shocker – producers claim to want lower prices!

Good grief, there’s a lot of tosh spouted on where oil prices are going after Russia and Saudi Arabia pulled the plug on the current rally, once Brent oil hit the magical $80/bbl target. The prize however, must go to Goldman’s straddle, where it seems the ‘technical’ analyst (someone who can draw straight lines) is […]

Continue readingIs the current oil price/sector rally getting played out?

It’s not exactly rocket science to work out that upstream oil profits and therefore oil major share prices are sensitive to prevailing oil prices. It therefore ought not come as too much of a surprise then to see sector share prices respond favourably to the better than expected rally in oil prices, with Brent hitting […]

Continue readingEnergy politics and fickle friends

Energy politics makes for fickle friends. A decade ago, Qatar was the US administration’s BFF, with its invitation to relocate the US regional military base from Saudi Arabia to Qatar in return for support to secure a pipeline access through Syria for its soon to be expanding natural gas production. As a way of pricking […]

Continue reading