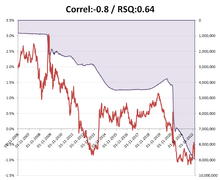

Pain at the pump? – blame the woke governments and not the oil majors!

In the UK, forecourt (pump) fuel prices are up +35% for both petrol and diesel (to 191p/199p respectively) from the last time the price of brent crude held above $120/bbl in Q1 2012. With the oil majors having all reported a strong increase in refining margins and downstream profitability, it must be tempting therefore suggest […]

Continue reading