- Home /

- Author's Archive:

What are we to do for entertainment once May goes? – Gove?

The impending demise of Theresa May’s government will be a sad loss to many of us who have been relying on our daily fix of gallows humour to keep us entertained. While many have been, and in some cases still are, deluding themselves that the EU is our friend and will negotiate a fair deal’ […]

Continue readingL’Empereur Micron makes the case for an EU army

“We have to protect ourselves with respect to China, Russia and even the United States of America,” Mr Macron told radio station Europe 1. And the occasional stroppy 12 year old student as well it seems!

Continue readingThomas Cook Group – analysis, or time for catastrophe modelling?

The recent gyrations in the Thomas Cook share price (a +50% surge yesterday and -13% correction today), might have you reaching for your catastrophe models, but its volatility after its latest guidance cut ought not to be that surprising. Combine a volatile top line with low margins, substantial financial leverage and a low rate of […]

Continue readingEngineering a ‘Santa Rally’ in oil, but what then?

If the price of continued US support after the Khashoggi murder was the lower oil price, then it must rank as one of the most expensive assassinations of journalist in history, with Saudi Arabia’s gross oil production revenues down almost $2bn per week. The attempt to resurrect his political reputation at the G20 meeting was […]

Continue readingWar by other means – interest rates

War by other means? Forget the South China sea, Syria or Korea. If you haven’t noticed, the EU and China are locked in a high stakes game of chicken with the US over control of the World’s reserve currency, where the weapon of choice are interest rates. While much has been made of Trump’s attempts […]

Continue readingBrexit means Brexshit!

Confused? You certainly should be as the political game of betrayal over Brexit reaches its denouement. In the very short term, markets (both fx and equity) are unfazed by the ‘deal’ being foisted on them, as they have already been softened up by the project fear propaganda – ‘any deal is better than no deal’. […]

Continue readingPearson – resorting to one-off non-cash tax items to try and spice up a tired recovery story

Pearson was for a while the darling of the sector, with a recovering top line supported by substantial cost reductions and an fx tailwind from the appreciation in its principal trading currency, the US dollar. Beyond this however, there was only limited evidence that the ship is being turned about, in terms of what really […]

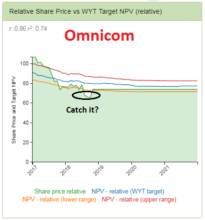

Continue readingOmnicom – yes it was oversold after Q2!

After seeing its shares tumble 10% immediately following its Q2 results, I added a position in Omnicom across a couple of portfolios I manage. It wasn’t that I was won over to the structural growth story for these marketing services agencies, but more a function of two things. Firstly, there is a price for everything […]

Continue reading