- Home /

- Author's Archive:

“It’s Putin wot’s doin it”.

In a reversal of what happened in Valens’ day, the migrant flow is now going north from the Danube towards Germania rather than south, although there is a new empire that is to be shaken by such a move and that is no longer ruled from the south. Having wagged her imperial finger at the […]

Continue readingFor GfK, another guidance miss could make it the next target

For more see: www.growthrater.com Having adopted a “shape for growth motto†for 2015, GfK is struggling to deliver, with its core syndicated electronic research business hit hard in Q2 from the backwash from weakening Chinese demand. While the group is doggedly maintaining its full year 2015 guidance to deliver growth in organic revenues and […]

Continue readingZoopla stabilises agency membership which sugar coats ‘Value Creation Plan’

For more see – https://www.growthrater.com/growthrater/#/summary Last trading report – IMS to end July 2015: The pill investors are being asked to swallow is a new incentive scheme that could reward the CEO with up to 7.5m new shares (via nil priced options) over the next 3 years dependent on a TSR exceeding +8% […]

Continue readingPearson CEO buys more time by selling FT Group and Economist stake

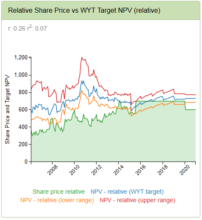

Pearson is pricing in a +3.9% CAGR growth rating but has delivered only +1% organic revenue growth in H1 FY15. Deferred revenues however were up +3% organic at end H1, which if translated into similar improvements in H2 organic revenue growth would put the group on course to perhaps delivering +4-5% for FY16 and therefore […]

Continue readingAmazon through the growth prism

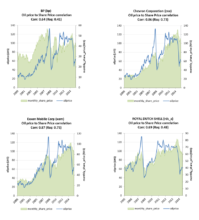

Markets often distinguish growth from value, but for an equity, growth defines value. For most stocks, this can be seen by the close relationship between the organic revenue growth being delivered by a company and the implied growth rating being discounted by the share’s operating FCF yield. A problem however arises when trying to price […]

Continue readingGoogle – markets chasing stories arrive late to the party

Markets love a good story. They’re so much easier to digest than actual analysis and usually provide a catalyst for action that brokers and journalists need to stimulate a transaction. Take for example Google’s Q2 results last Thursday. The results themselves were solid, but were neither significantly ahead of street estimates nor provided anything particularly […]

Continue readingGet the oil price right and make the right call on oil stocks

Invest in an oil major such as Exxon or Chevron and there are two over-riding factors to consider. The first and probably obvious one for Groups which traditionally make over three quarters of their income from pumping oil and gas out of the ground is the price of oil. While an oil spill and >$40bn […]

Continue readingTsipras makes Merkel an offer she can’t refuse

How should we interpret this week’s volte-face by Tsipras and the Syriza government in approving austerity concessions to the Troika that had been specifically rejected by Greek voters in a referendum less than a week before? Short term, this would seem to provide an opportunity for celebration for creditors and financial markets in that the […]

Continue reading